Buy To Let

Clamp down on inactive holiday let owners who claim tax relief

Guest Author:

Liz BuryClamp down on inactive holiday let owners who claim tax relief

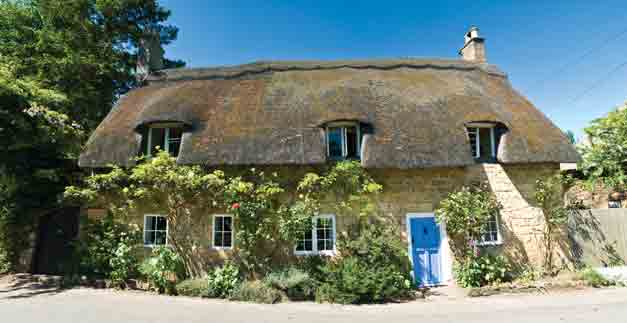

In England, holiday lets are liable for business rates, rather than council tax, if the owner says they will make the property available to let for 140 days in the coming year. However, there are no checks on whether or not the owner actively tries to let the property.

Of the more than 60,000 holiday lets on the business rates list, about 96 per cent have a rateable value which would likely qualify for Small Business Rates Relief — meaning they would pay no business rates at all.

The government will now legislate to prevent owners of properties that are not genuine lettings businesses from reducing their tax liability in this way.

The news follows a consultation by the Ministry of Housing, Communities and Local Government (MHCLG) on business rates treatment of self-catering accommodation, which ran from November 2018 to January 2019. MHCLG will publish its response shortly.

The holiday let market has generated great interest since the pandemic hit restricting holidays abroad, with brokers calling for lenders to launch new products.

Why Life Insurance Still Matters – Even During a Cost-of-Living Crisis

Sponsored by Post Office

The announcement on Tax Day, 23 March 2021, is part of a wider ten-year plan to modernise the tax system which was outlined by the government in July 2020.