Buy To Let

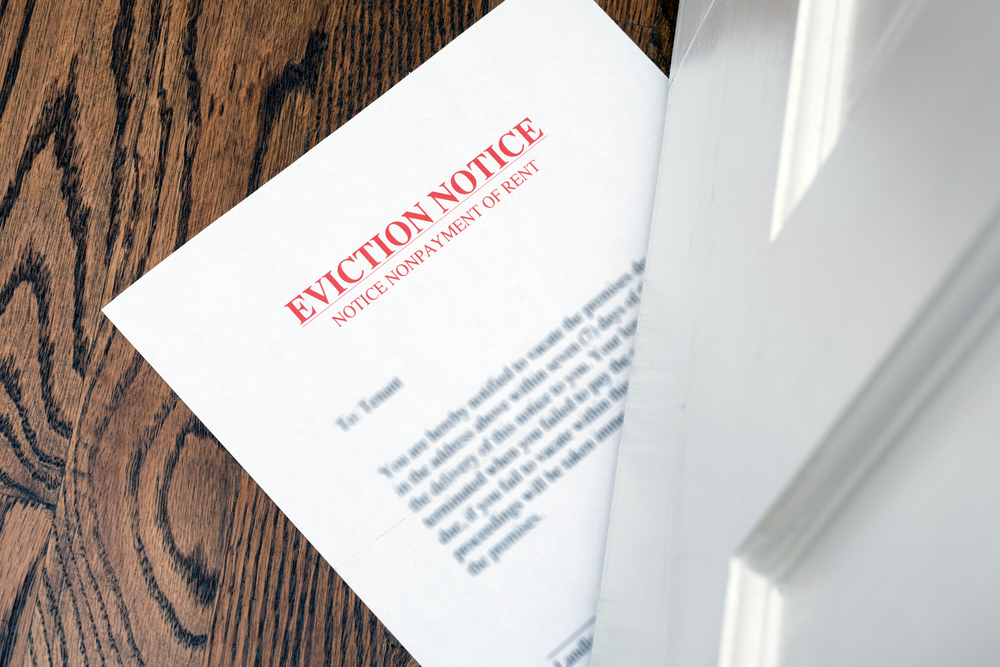

Eviction ban extended – but still no financial support for tenants

Residential tenants will not be removed from their homes by bailiffs until 31 May at the earliest after the government extended the coronavirus eviction ban.

Renters will only have their homes possessed in the ‘most serious circumstances’ such as incidents of fraud or domestic abuse.

The requirement for landlords to provide six-month notice periods to tenants before they evict will also be extended until at least 31 May. It was previously due to end on 31 March.

Housing secretary Robert Jenrick said the measures will be kept under review in line with the latest public health advice.

Richard Lane, StepChange director of external affairs, said: “The government’s continued suspension of rental evictions until the end of May is a welcome step which will gives renters affected by the pandemic vital time to get back on their feet.

“However, renters are among the groups hit hardest by the pandemic, and many of those struggling have fallen well behind on their rent or resorted to borrowing to get by. With wider restrictions due to continue until at least the end of June and the economic effect of the pandemic expected to go on well beyond that, renters have little hope of a return to anything like normal by May.

“Without targeted financial support, many renters are at risk of losing their homes. We need urgent action to prevent homelessness, housing insecurity and long-term problem debt from taking hold when the newly extended suspension is lifted.”

Ben Beadle, chief executive of the National Residential Landlords Association, said: “That said, the further extension to the repossessions ban will do nothing to help those landlords and tenants financially hit due to the pandemic. Given the cross-sector consensus for the need to address the rent debt crisis, it suggests the government are unwilling to listen to the voices of those most affected.

“If the chancellor wants to avoid causing a homelessness crisis, he must develop an urgent financial package including interest free, government guaranteed loans to help tenants in arrears to pay off rent debts built since March 2020. This is vital for those who do not qualify for benefit support. Without this, more tenants face losing their homes, and many will carry damaged credit scores, making it more difficult to rent in the future and causing huge pressure on local authorities when they can least manage it.”

Both the NRLA and StepChange are calling for a financial package from the government that helps tenants deal with their rent arrears through a system of grants and no-interest loans.

The Scottish government announced this week that it was extending its support for landlords and tenants, a package which includes interest-free loans.