Retirement

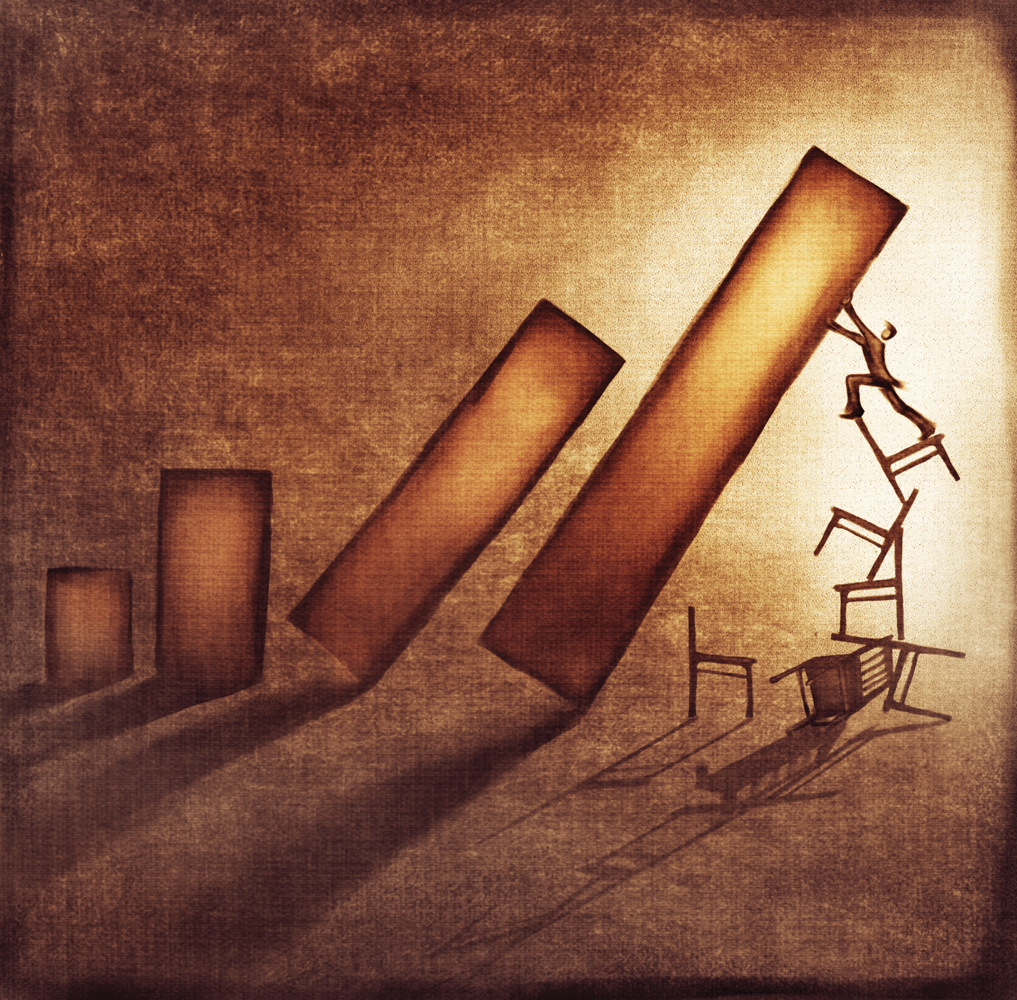

Annuity rates in ‘free fall’

The rates of interest paid out on pensioners’ annuities have dropped 7% since June and enhanced rates have fallen 5% in the same period, according to analysis from provider MGM Advantage.

The firm said these were the largest quarterly drops recorded by its Annuity Index since it started tracking rates in August 2009.

Overall rates have dropped by 20% since August 2009, it added.

Aston Goodey, distribution and marketing director at MGM Advantage, predicted further falls.

He explained: “Annuity rates are in free fall, largely driven by record low gilt yields. Annuity providers have yet to fully price in the effects of Solvency II or the EU Gender directive so we expect further falls over the coming months unless we see a significant upward movement in gilt yields.”

People with money purchase pension schemes are obliged to spend 75% of their pension pot on an annuity, which then pays out an income until they die. Annuities invest in super-safe vehicles such as Government bonds, also known as Gilts. Falling rates mean falling pensioner incomes.

Meanwhile, fixed term annuity specialist Primetime Retirement said a poll of advisers had revealed renewed interest in alternatives to traditional lifetime products such as basic annuities.

It said 77% of specialist retirement income advisers thought the fixed term annuity market would grow in the next two years. The research also found 76% of those advisers had seen an increase in the number of clients asking for advice on annuities and retirement.