Retirement

Chancellor looks to up tax on pensions of rich

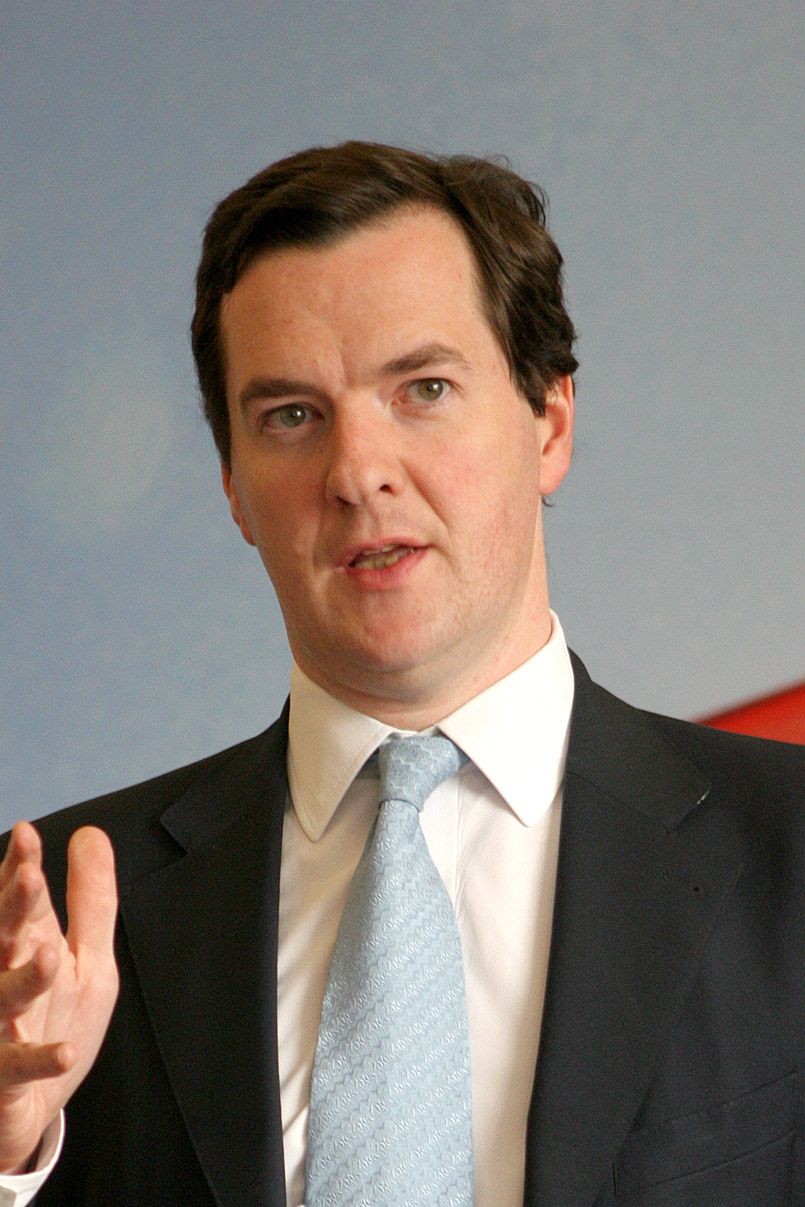

George Osborne is considering a new tax raid on the pension contributions of richer voters, after rejecting the idea of a “wealth tax” based on higher council rates for luxury homes and apartments.

The chancellor has promised to balance a planned welfare squeeze – needed to achieve a futher £10bn of benefit savings by 2015-16 – by imposing new taxes on the wealthy.

Although Osborne’s aides insist this is not part of a “trade-off” with the Tories’ Lib Dem coalition partners, the search for new revenues is coming to a head in the run-up to his Autumn Statement on 5 December. according to the Financial Times.

Osborne has to send his final proposals to the independent Office for Budget Responsibility by 28 November.

The Chancellor met senior coalition colleagues on Monday to discuss options. Officials close to the talks said that moves to reduce the tax relief available for wealthier voters on their pensions were “on the table”.

Liberal Democrats have long argued for such restrictions. In his first emergency Budget in 2010, Mr Osborne cut the maximum annual pension contribution exempt from tax from £255,000 to £50,000.

A new threshold of £40,000 is expected to raise about £600m, while a further cut in the threshold to £30,000 would raise £1.8bn, but bring howls of protest from traditional Tory voters.