News

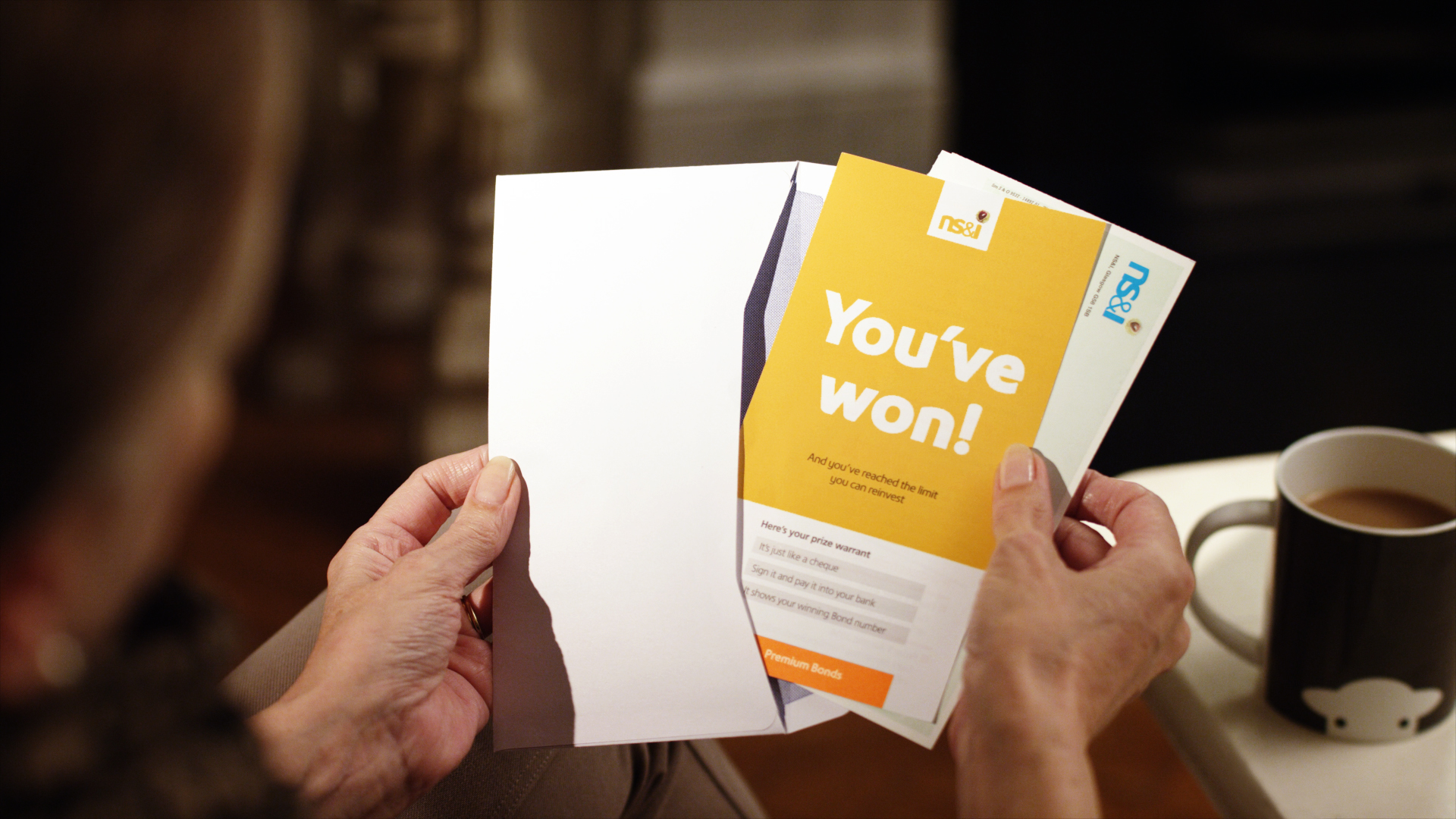

April Premium Bonds winners revealed: have you won £1m?

A Premium Bond holder from Warwickshire and another from Kent have scooped the £1m jackpot for April.

They become the 407th and 408th Premium Bond millionaires to receive a visit from Agent Million, the person who visits winners face-to-face to tell them they’ve won the windfall.

The winner from Warwickshire has £41,600 invested in Premium Bonds and bought the winning bond in January 2013. The winning bond number is 201SW331874.

The winner from Kent has £30,000 invested and bought the winning bond in April 2006. The bond number is 108RY588717.

Premium Bonds offered by the government-backed National Savings & Investments (NS&I) are the UK’s most popular savings product. Each £1 bond is entered into a monthly draw, with two lucky bondholders bagging £1m each.

Today marks 25 years since the £1m jackpot prize was introduced.

Jill Waters, NS&I retail director, said: “Making 408 millionaires to date is no mean feat and our Agents Million have been there every step of the way, surprising, delighting and reassuring all of our customers who have been lucky enough to join this exclusive jackpot winning group.”

How to check if you’re a winner

Each month, two lucky people scoop the £1m jackpot. But over 3 million tax-free prizes are won in each prize draw ranging from £25 to £100,000.

There are over 1.5 million unclaimed Premium Bonds prizes, worth £61m.

Bond holders can check if they’ve won using use Amazon’s Alexa, the prize checker on nsandi.com, as well as the official Premium Bonds prize checker app.

Since February, it has been possible to buy Premium Bonds with a minimum investment of £25. They can be bought as a gift for children under 16 by parents and grandparents.