News

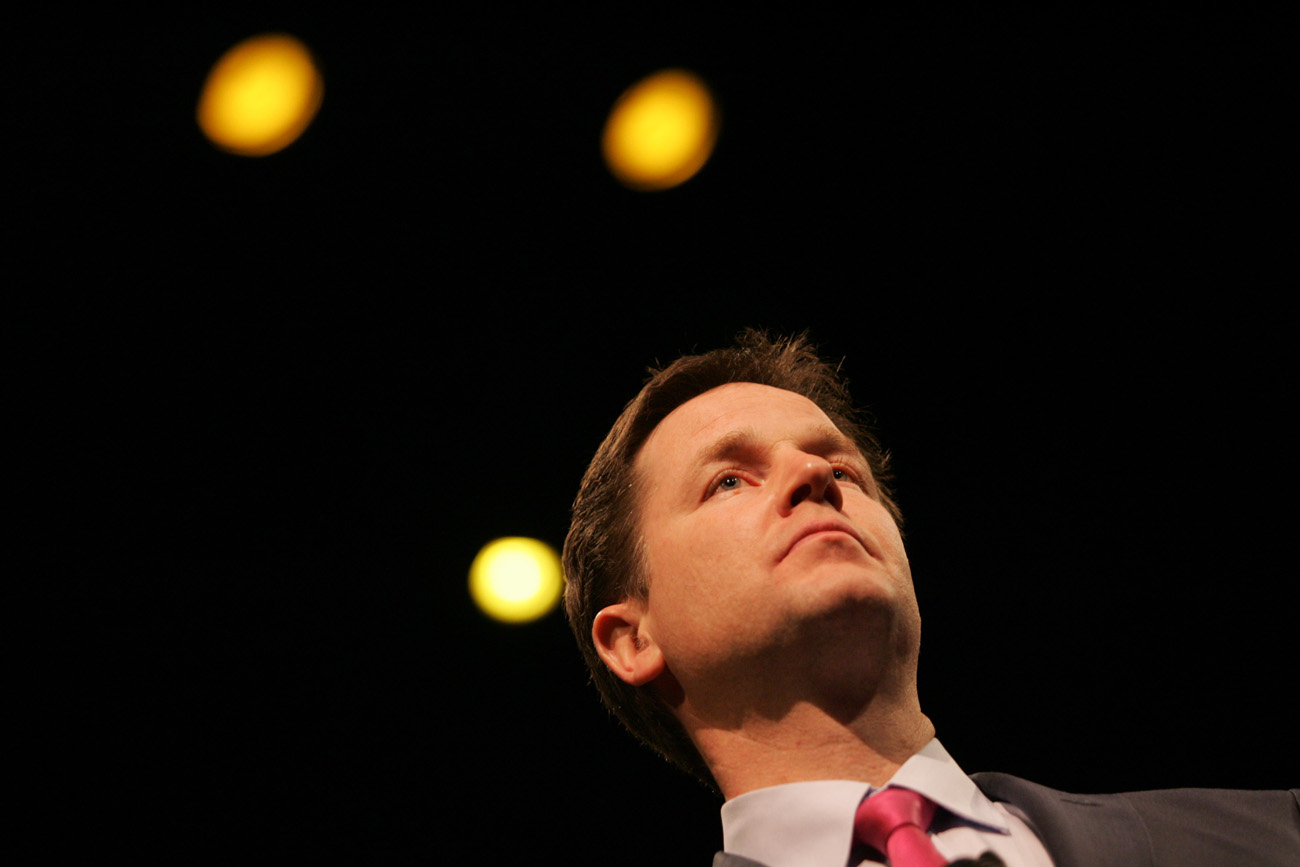

Clegg: Cut benefits for wealthy pensioners

Deputy Prime Minister Nick Clegg has called for benefits such as free television licences, winter fuel payments and bus passes to be taken away from wealthy pensioners.

While committing the coalition government to universal benefits until 2015, the Liberal Democrat leader said the issue needed to be reconsidered after that and suggested wealthy pensioners should voluntarily surrender some benefits in order to help “make ends meet”.

“We have ruled out in the Coalition Agreement changing what are called age-related universal benefits: free TV licences, winter fuel payments and free bus passes,” he said in an interview with the BBC.

“My own view is for the future that it would be very difficult to explain – and it would be quite interesting if you could ask the Labour Party this, because they appear to be saying that at a time when people’s housing benefit is being cut, we should protect Alan Sugar’s free bus pass.”

His barb at Lord Sugar drew a sharp response from the Apprentice boss, who hit back at Clegg on Twitter.

He said: “The twit Nick Clegg moaning about me having a bus pass. Idiot I haven’t got one.

Why Life Insurance Still Matters – Even During a Cost-of-Living Crisis

Sponsored by Post Office

“Even if I did have a bus pass, I’ve personally paid tens of millions tax, my companies hundreds of millions in the past 45 years. What has Clegg done?”

Clegg will today address the Liberal Democrat Autumn Conference as it comes to an end.