News

Digital bank launches top-paying 1.5% savings account

US banking giant JPMorgan Chase has launched a market-leading savings account offering 1.5%.

App-only challenger bank Chase has launched a saver account paying 1.5% AER/1.49% gross (variable) – the highest rate seen since September 2019, Savings Champion data revealed.

It has raced ahead in the best buy tables, smashing the current 1% offered by Virgin Money, Aldermore’s 0.95% and Atom Bank’s 0.90%, according to Moneyfacts figures.

It’s an easy access account so you can take your money out when you need it, and there are no fees or charges in doing so.

While technically this is a linked saver account – so you do need to open a current account with Chase – you won’t need to shut your main or existing current account to be eligible.

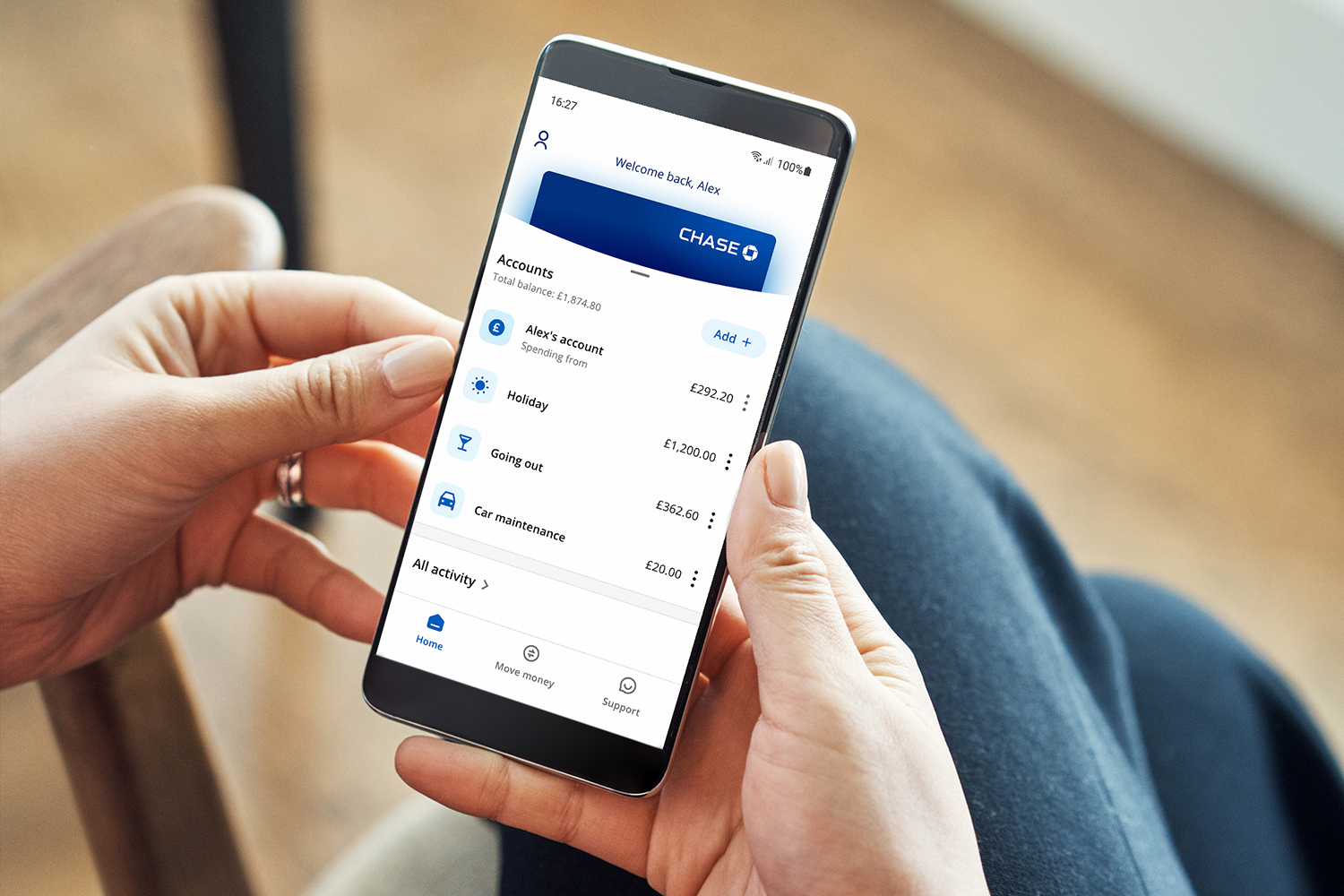

As such, the Chase account can be used as a secondary home for your cash. But as it’s a digital bank, you can open and manage the saver account in the Chase app.

Why Life Insurance Still Matters – Even During a Cost-of-Living Crisis

Sponsored by Post Office

There’s no minimum deposit; customers can open up to 10 saver accounts and the maximum balance is £250,000.

On a £1,000 deposit (no withdrawals) you would earn £15 in interest over the year.

Chase launched its UK bank account in September 2021. It offers 5% interest on round-up spending. For example, if a customer spends £1.90, 10p will be moved to a separate savings account where interest is paid monthly.

The account also offers 1% cashback for 12 months on debit card spending, and it’s free to use abroad – including ATM withdrawals.

Shaun Port, managing director – savings and investments for Chase in the UK, said: “With the cost of living increasing, we know that consumers want to maximise the interest they can earn with the reassurance of being able to access their savings instantly.

“We have designed the Chase saver account to provide our customers with maximum flexibility alongside a competitive rate. Savers can set up multiple accounts via the Chase app, each with a unique account number, making it easy to organise their savings for specific goals. There are no fees or charges when customers move money out of their saver accounts, no monthly caps on how much can be saved provided total savings are within the £250,000 limit for all saver accounts.”

‘Attractive option’

Anna Bowes, co-founder of Savings Champion, said: “It’s great to see another big bank entering the UK market and offering a great rate to encourage new customers. And just like the ‘Marcus’ effect, it would be great to see more savings providers trying to challenge Chase as this would push best buy rates back to rates we’ve not seen for years. The last time an easy access account was paying as much as this was September 2019 – so back to pre-pandemic levels.

“You do need to open a current account in order to have access to the savings accounts and it needs to be opened and managed via the Chase mobile app – but you don’t need to switch your main account. But it’s quick and easy to do so worth considering.”

Eleanor Williams, finance expert at Moneyfacts, added: “Following the recent base rate increases, it’s great for savers to start seeing higher rates offered on easy access accounts and see increasing levels of competition returning to this sector of the savings market. While the cost-of-living crisis continues, many savers may not want to lock their cash away in a fixed account and so this could well be an attractive option for those looking to keep their nest egg somewhere they can maintain flexible, unrestricted access to.”