News

Have you won £1m in July’s Premium Bonds draw?

A man from Tyne and Wear and a woman from Surrey have become the latest winners of the life-changing £1m Premium Bonds jackpot.

The lucky man from Tyne and Wear only bought his winning bond in May 2020 and had £35,000 invested. He scooped the £1m prize with bond number 392SK696449.

He becomes the tenth £1m jackpot winner from Tyne and Wear.

The second new millionaire is a woman from Surrey who had the maximum £50,000 invested in Premium Bonds. She bought the winning bond number – 297WB837011 – in March 2017.

She is the 25th Premium Bonds millionaire from Surrey.

There were 3.7 million prizes up for grabs in the July draw, worth £106m.

There were 90.9 billion eligible bonds for the draw. Since the first draw in June 1957, 487 million prizes have been drawn with a total value of £20.8bn.

How to check if you’re a Premium Bonds winner

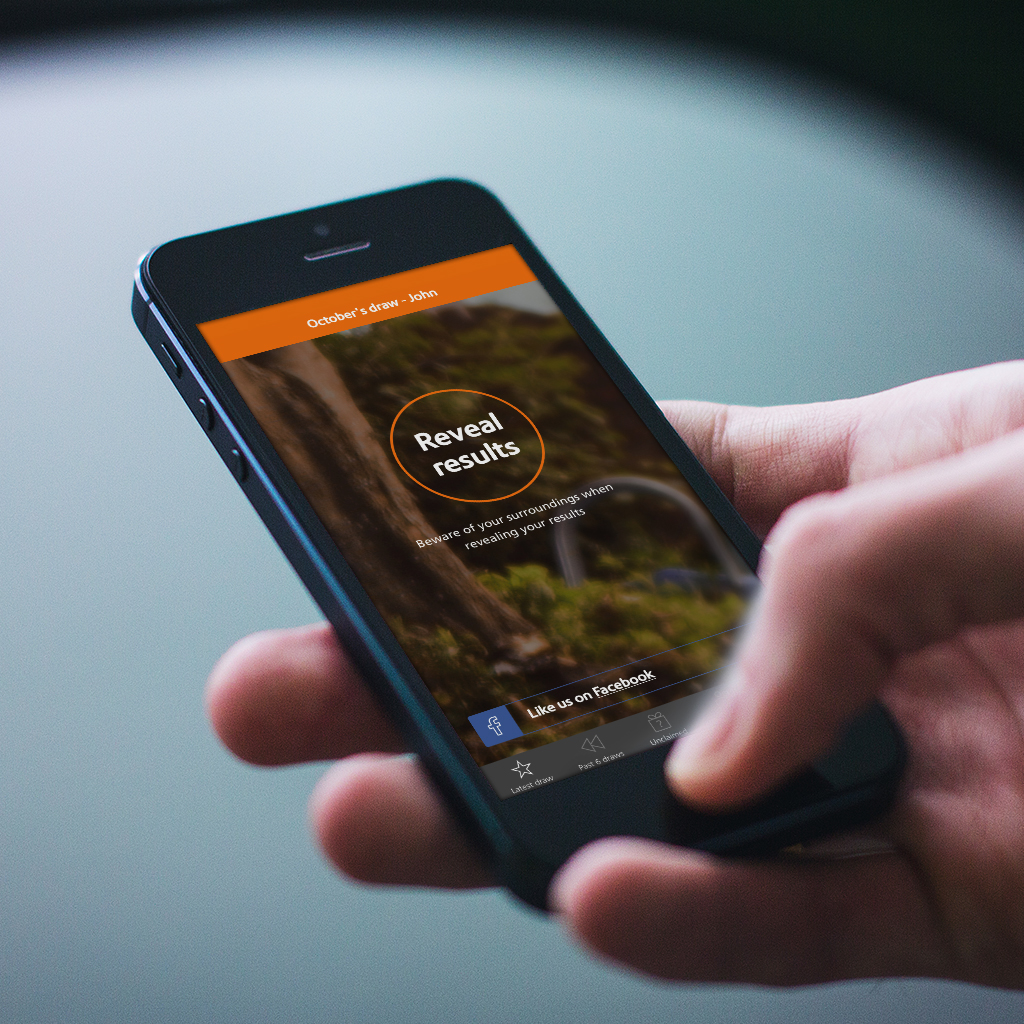

Premium Bonds holders will be able to check if they’ve won an amount between £25 and £100,000 via the nsandi.com prize checker and prize checker app from tomorrow (Thursday 2 July). You’ll need your Premium Bonds holder’s number.

If you’ve previously chosen to have prizes paid into your bank account, or have prizes reinvested, you will receive an email or text message to inform you if you’ve won. You can then visit the online prize checker at nsandi.com or view the NS&I prize checker app to see the value of your prize.

If you receive warrants (like a cheque), you’ll receive notification of any wins through the post.

NS&I Premium Bonds prize warrants are valid for three months, however the warrants may still be accepted at a later date by the bank – up to six months. However, if the bank won’t accept the warrant, NS&I can send a new warrant.

Jill Waters, NS&I’s retail director, said: “When people think of Premium Bonds they often recall memories of a prize warrant landing on their doormat, but since the introduction of paperless prizes we’ve seen a good uptake in the number of customers choosing to have their prizes paid directly into their bank account. In June alone just over 70% of Premium Bonds prizes were paid out in this way – making it the quickest and most convenient way for people to receive their prizes.

“Premium Bonds holders can choose to have their prizes paid directly into their bank account, or to have any wins reinvested up to the maximum holding amount of £50,000, by registering for NS&I’s online services with a valid email address or mobile phone number. Money put aside each month can quickly grow into a small nest egg with the added bonus of a potentially life-changing prize.”