Money Tips

NS&I controversially cuts cash ISA rate: what are your options?

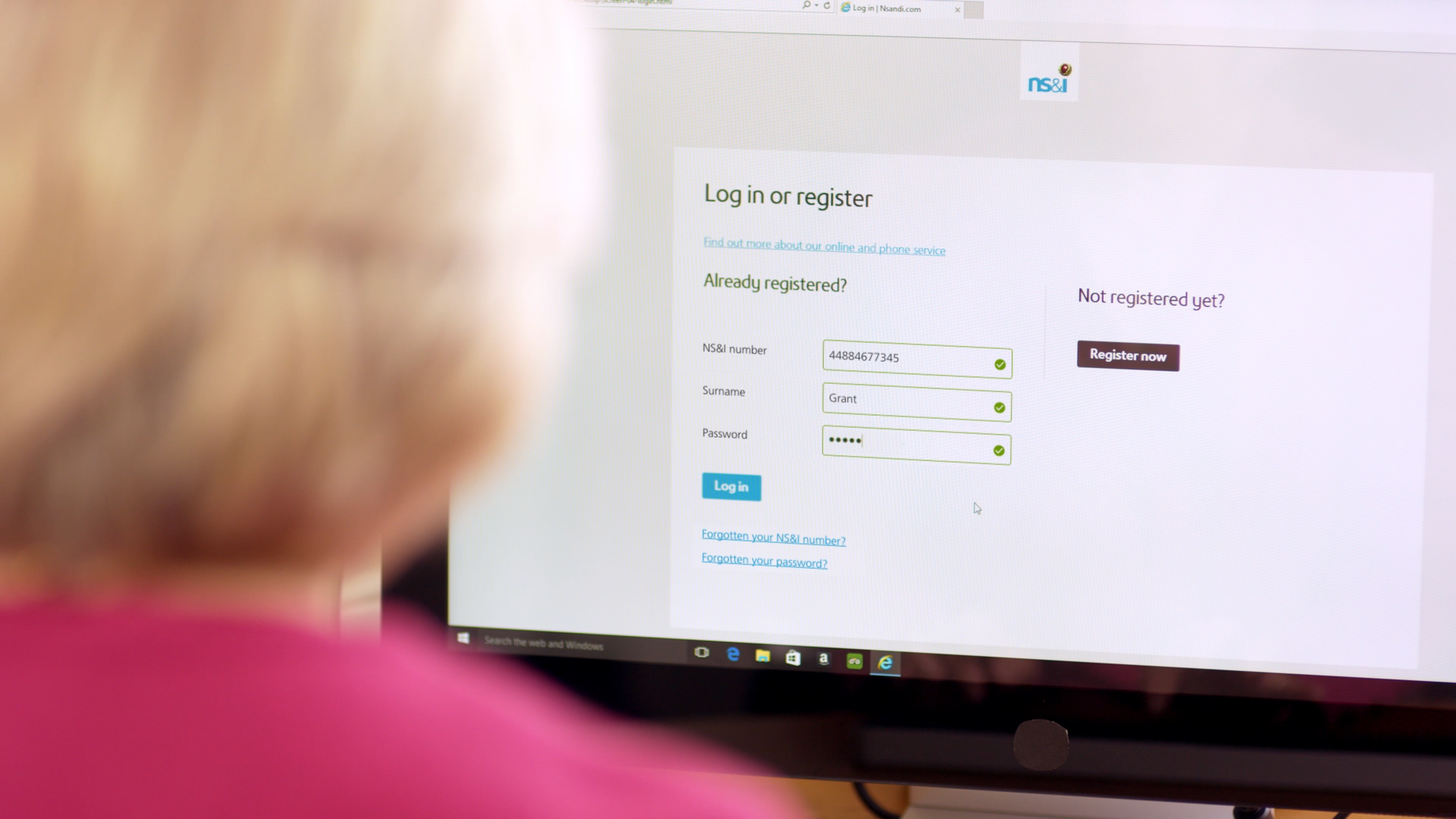

More than 380,000 savers with a National Savings & Investments (NS&I) Direct ISA will see their rate drop from 1% to 0.75% from today.

The reduction was announced in July but is still going ahead despite the fact the Bank of England raised the base rate by 0.25% to 0.75% early last month.

Anna Bowes of rate monitoring firm Savings Champion, said: “At a time when savings rates are heading downwards, it’s a disgrace that NS&I is cutting the rate on this cash ISA.

“While NS&I did make this announcement well in advance, on 16 July, many would have hoped that there would be a change of heart following the base rate announcement that happened two weeks later.”

NS&I, the government-backed provider, is popular with savers because your money is fully protected. But as long as you have no more than £85,000 with one banking group, your money is safeguarded under the Financial Services Compensation Scheme (FSCS).

According to Savings Champion data, over 63% of easy access cash ISAs currently available to open, are paying more than 0.75% – so there is plenty of choice.

“Savers should really be switching their funds in order to earn a decent rate of interest,” said Bowes.

“But remember the golden rule of switching your cash ISA – don’t cash it in yourself. You need to complete a transfer form with your new provider and they will arrange the transfer for you.”

Where to go for better rates?

You can currently earn 1.35% on an easy access ISA from Al Rayan Bank and even more if you are prepared to give notice or tie your money up into a fixed rate cash ISA.

Charter Savings Bank pays 1.40% on its 95 day notice cash ISA, while Coventry Building Society offers 2.30% for its 5-year fixed rate ISA.

If you want to tie your money up for a shorter time, Paragon currently pays 1.55% on its 1-year ISA and Shawbrook Bank offers 1.75% on its 2-year ISA.