News

Revolut launches app for under-18s

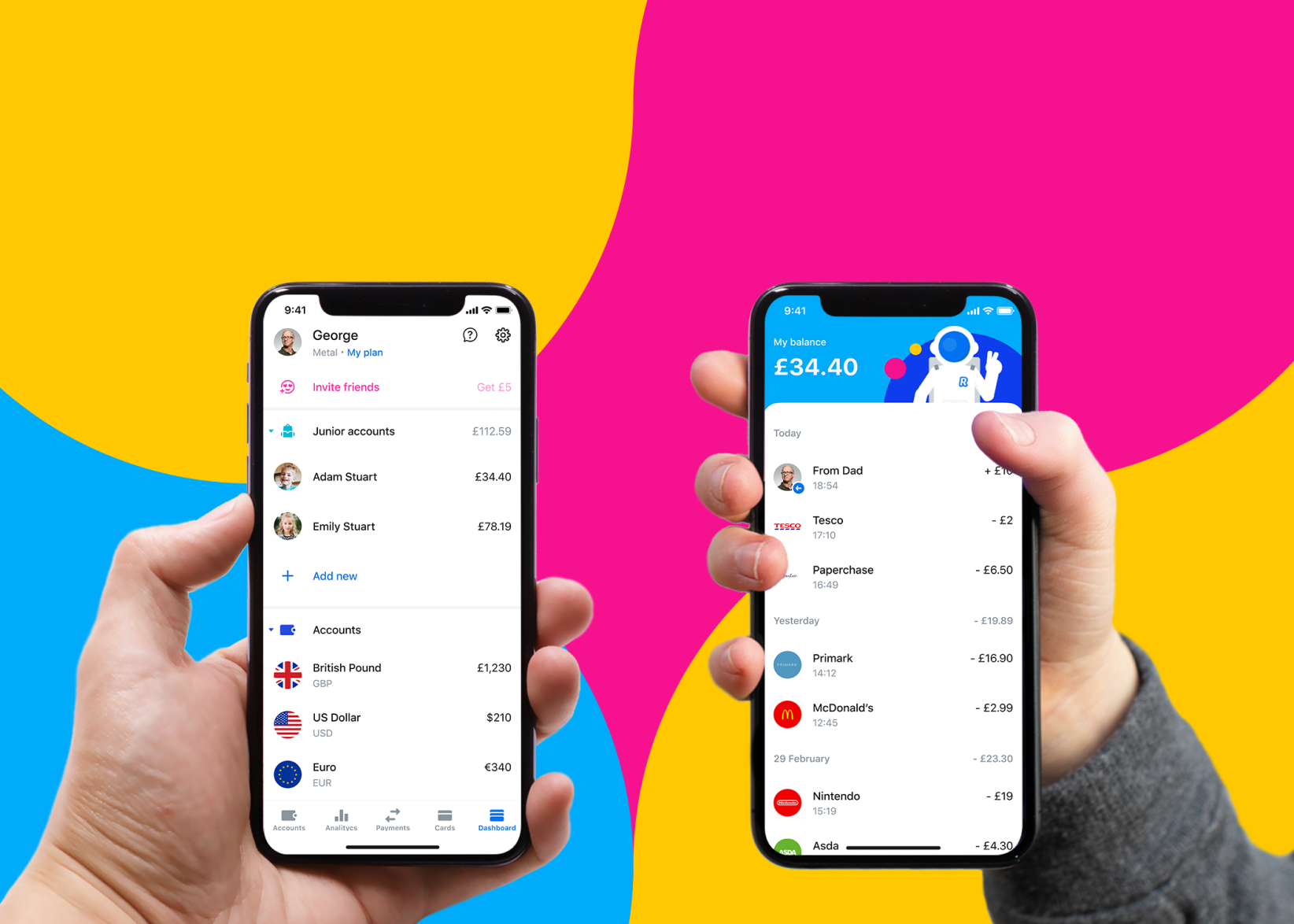

Revolut has launched Revolut junior – a money management app designed for children to be used under the supervision of an adult.

The app is tailored to children aged 7-17 and aims to promote good money habits from an early age.

The junior account can only be created by a parent or legal guardian who is an existing Revolut user (paying Premium and Metal customers) within the app. It is a separate account to the adult one but adults are responsible for everything on the junior account. You can have more than one Revolut junior account.

Parents can transfer money to their child’s account and access balances and transactions, and they will also get notifications about their child’s spending.

Kids can then view their transactions made on their Revolut junior account using the junior app. They will also be issued with a card linked to the account that they can use to spend and withdraw cash, though parents can control card transactions and online payments.

If you order a Revolut junior card, the same fees apply as for the tier of the Revolut personal account which you hold (e.g. personal, metal). If a fee does apply, you’ll be shown in the app before you incur it, and it will be charged to your Revolut personal account.

However, children won’t be able to make or receive transfers using the junior app. And if they try to spend money when there aren’t sufficient funds, the transaction will be declined, even if there are funds in the adult personal account.

Revolut plans to add other features throughout the year, including the ability to set a regular allowance, financial tasks and goals, savings options, spending reports, spending limits and eventually financial guidance for kids to help develop their financial skills.

Aurelien Guichard, product owner for Revolut junior, said: “Helping kids develop financial skills is what is driving us. Conversations about money typically start at home and we believe these skills are gained little by little, through experience and with help of parents and guardians.

“Revolut junior ‘grows’ with kids until they are eligible for a standard 18+ account so that once they are independent, they have the financial skills and literacy to avoid potentially costly mistakes.”