News

Saving for the future isn’t a priority for the UK

More and more people are neglecting the need to save for their futures.

While the housing market is moving again and the UK economy is continuing to improve, things look like they’re on the up. But for many people in Britain, living in the now and avoiding saving, the future doesn’t look so bright.

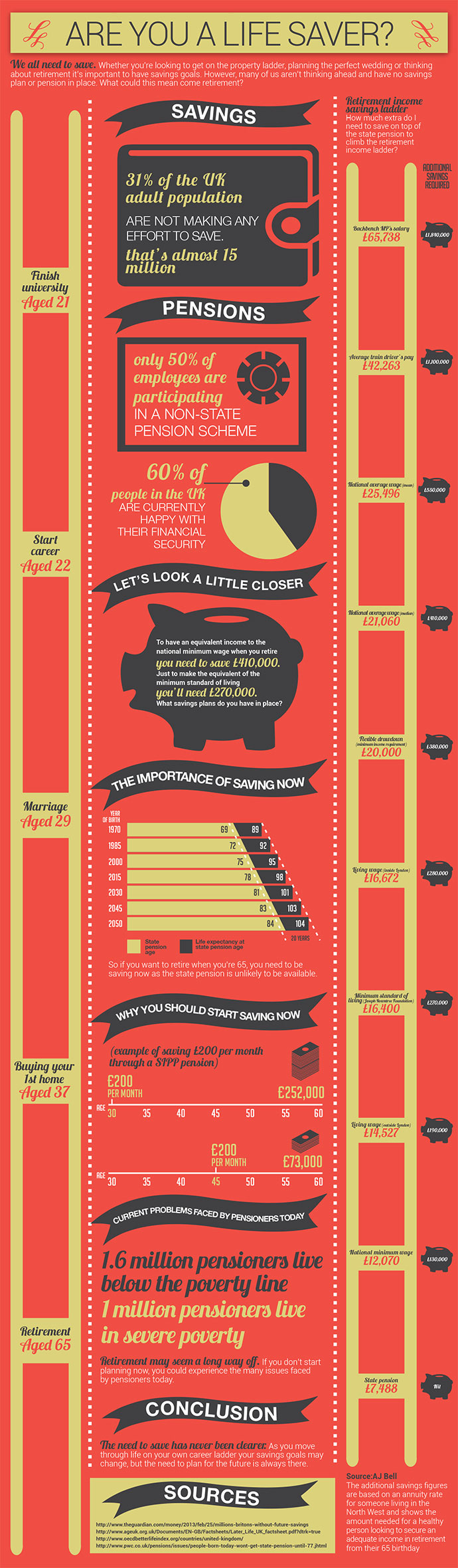

The stats in the below infographic from AJ Bell Youinvest highlight the real problems that many could face if they don’t start saving now.

The facts are clear. Over a third of the UK adult population are not making any effort to save. Only 50% of employees are participating in a non-work pension scheme. This immediately suggests a lack of awareness of the importance of putting some funds away for the coming years.

Delving a little deeper into the below stats, we can see the amount of additional funds (on top of the state pension) that is needed to guarantee a certain standard of living. Specifically, the Retirement Income Savings Ladder shows that in order to guarantee the minimum standard of living come retirement, a total amount of £270,000 is needed in addition to the state pension. The figures are big. The plans for your future savings must begin now.

Click here for an enlarged version

Are you a life saver? – An infographic by the team at AJ Bell Youinvest