Insurance

Check your warranty before replacing goods

Brits are throwing away more than £400m each year by buying replacement goods when the items are already covered by a warranty.

UK consumers are chucking away an estimated £423m each year by replacing household appliances and electrical goods without checking their warranties on the faulty item.

While 35% of shoppers hang on to receipts for up to two years as proof of purchase, they fail to use them when it comes to replacing them. instead, one in five buy replacement goods without checking their warranty.

According to MyVoucherCodes, over a third of UK consumers have never made a warranty claim on a faulty or broken item.

Millennials spend double the amount (£228) buying replacement goods than those aged over 55 (£108).

Millennials also said they would only consider taking back an item if it was under four months old but for those age 55+, they would take back a faulty or non-working item up to 11 months after purchase.

However, the standard warranty period in the UK is two and a half years, according to the voucher site.

More women tend to not check the warranty status when appliances stop working while men are more likely to buy new – spending double the amount (£239) for women (£152) a year.

TVs top the list of items that Brits care most about when it comes to their warranty (45%) and here are the top 10 items:

- TVs – 45%

- Washing machines – 41%

- Mobile phones – 40%

- Microwaves – 29%

- Vacuum cleaners – 29%

- Ovens – 25%

- Toasters – 23%

- Tumble dryers – 22%

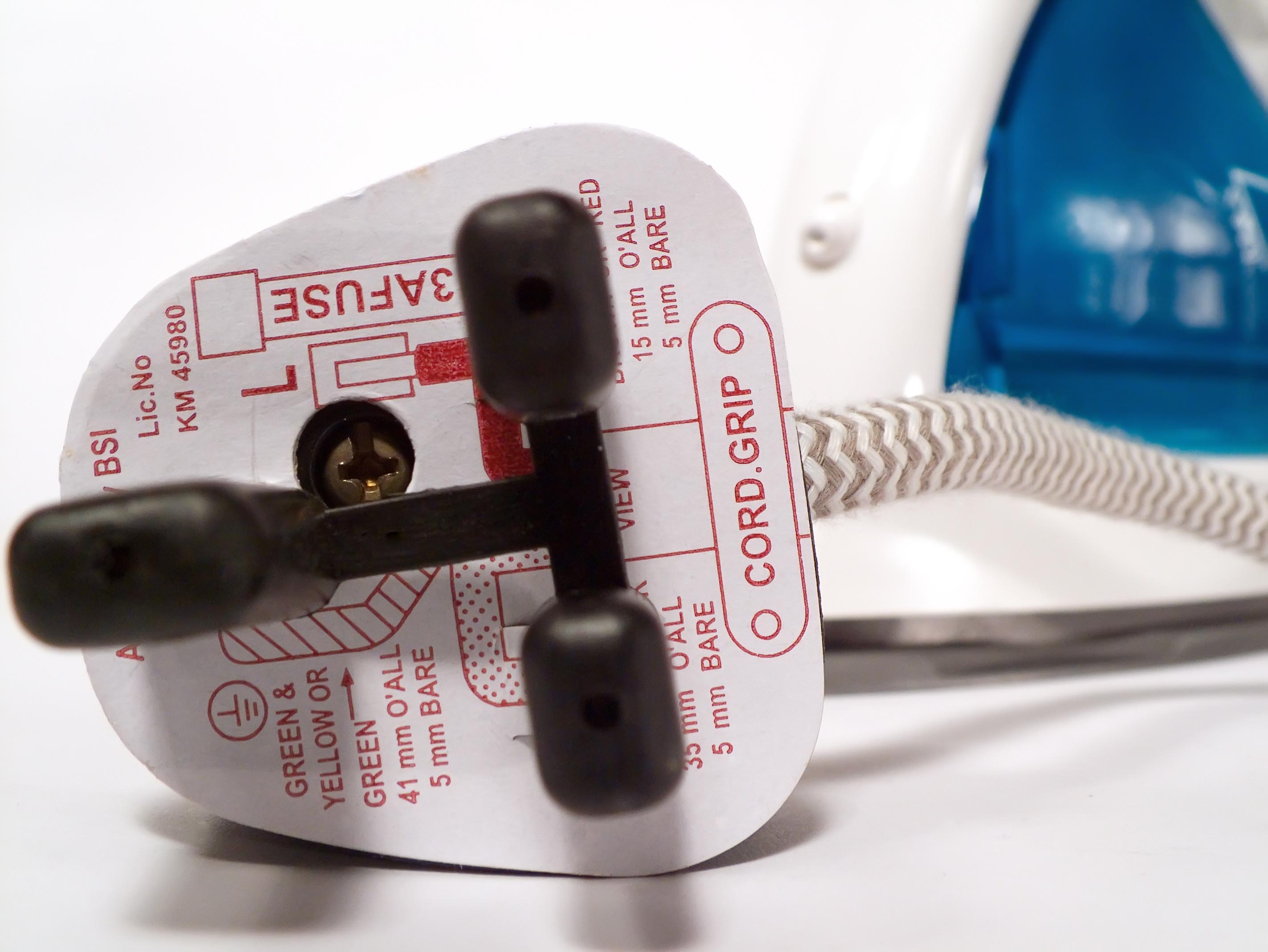

- Irons – 21%

- Hair dryers – 19%

- Dishwashers – 18%

Londoners are named as the savviest with 80% making savings by following through on manufacturer promises while just half of residents in the South East are doing the same.

Chris Reilly, managing director of MyVoucherCodes, said: “Checking your warranty can seem tedious, but it’s so important if you want to avoid spending money on unnecessary replacements or repairs.

“We recommend retaining your proof of purchase for a minimum of two years in a safe place, so you can easily review if required. However, if you do get caught out, be sure to check online to ensure you’re getting the best deal.”