The High Income Child Benefit Charge (HICBC) threshold will rise to £60,000, taking tens of thousands of families out of paying the tax. But how much Child Benefit will you receive, and how much can you earn before having to pay some or all of it back?

In a bid to address the “confusing” and “unfair” Child Benefit tax system, Chancellor Jeremy Hunt yesterday confirmed the threshold will rise from £50,000 to £60,000 this April.

Currently, the benefit is paid to the parents and guardians of children under the age of 16, or under 20 if they stay in approved full-time education or training. It is currently set at £24 per week for the eldest child and £15.90 per week for each younger child.

In the new tax year in April, it will rise to £25.60 for the first child and £16.95 for subsequent children.

But Child Benefit is withdrawn when one parent earns over £50,000 (net) per year, though two parents each earning £49,000 per year receive it in full.

Those with income above £50,000 are required to pay 1% of the Child Benefit for each £100 of income above this. This means the value of Child Benefit is eroded to nil once the taxable income of one of the adults exceeds £60,000.

As an example, if you have an income of £55,000, you’d have to pay half of it back, which needs to be done via a tax return, even if you’re usually PAYE.

As such, latest figures from the Government revealed more than 680,000 families opted out of receiving the benefit altogether, while others have paid back over £3bn since the HICBC was introduced in 2013.

Raising the threshold

The HICBC threshold will rise from £50,000 to £60,000, while the upper limit will rise to £80,000.

As such, the charge is tapered for those earning between £60,000 and £80,000, with the benefit not being repaid in full until you earn £80,000.

The taper range will double, so the rate of charge is halved from the current 1% of Child Benefit for every £100 earned above the threshold to 1% for every £200.

According to Laura Suter, director of personal finance at AJ Bell, this means losing the benefit at a slower rate than currently.

“It means that someone earning £70,000 will lose 50% of the Child Benefit they’re entitled to, while someone on £75,000 will lose 75% of the amount,” she explained.

The Government estimates that nearly half a million families will gain an average of £1,260 in 2024/25 as a result of the change.

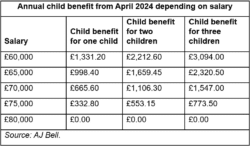

But below are calculations from AJ Bell showing what the change means (click to expand):