Grocery price inflation has fallen nine times in a row to stand at 9.1% at a time when Christmas shoppers are expected to shell out a record £13bn this December.

In the four weeks to 26 November 2023, sales reached £11.7bn, leading analysts Kantar to expect a bumper December as households stock up for the festive season.

Sales have grown 6.3% in the period, while shoppers typically buy 10% more items in the run-up to Christmas compared to a typical month.

Friday 22 December is predicted to be the single busiest day in store as people rush to buy all the trimmings ahead of the big day. Nearly 41 million brussels sprouts are forecast to be sold every day in the week before 25 December.

Meanwhile, grocery price inflation has eased back from 9.7% to 9.1%, while it stands at 9.6% for the 12-week period ending 26 November.

Kantar said prices are rising fastest on eggs, sugar confectionery and frozen potato products.

However, it said that retailers are “battling it out to offer value to consumers during this important month for trading and are doing what they can to keep prices low”.

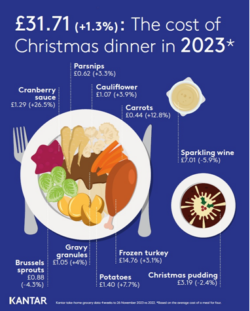

As such, the cost of Christmas dinner for four has risen well below the overall inflation rate at 1.3% to stand at £31.71, with some festive favourites falling in price this year. Brussels sprouts are now 4.3% cheaper than 12 months ago.

Kantar added that retailers are putting emphasis on own-label lines and promotions in a bid to attract people through their doors.

Indeed, spending on offers hit its highest level in over two years in the latest four-week period (28.4%).

Fraser McKevitt, head of retail and consumer insight at Kantar, said: “The amount of money spent on deals usually leaps in the run-up to Christmas, but this year is already looking a bit different. We’re well above 2022 levels, with customers making an additional £180m in savings this November versus 12 months ago.

“Brands have benefited from the boost in offers and have now edged ahead of their own-label counterparts, growing sales by 6.5% versus 6.4% for retailer lines.”

McKevitt added that premium lines are also “doing well”. These products are up by 15.4% year-on-year, with wine, chilled ready meals and fresh beef among the big winners last month. Kantar is also expecting to see a seasonal jump in premium stuffing, sausage meat and Christmas puddings over the coming weeks.

Supermarket market share

When it comes to retailers’ market share, Sainsbury’s clawed back 0.4 percentage points to reach 15.6% – its largest market share gain in over a decade.

The continued success of its own-label goods and 23% increase in its ‘Taste the Difference’ range year-on-year added to its appeal.

Tesco also increased its market share to 27.5% following a growth in sales of 8.6%, marking the fifth month in a row that Britain’s largest retailer has made gains.

Of the budget retailers, Lidl is again the fastest growing grocer, boosting sales by 14.2% over the 12 weeks to 26 November to take a record high share of 7.8%. Aldi increased sales by 11.1% to hold 9.6% of the market.

Elsewhere, sales at Asda and Morrisons were up by 2.6% and 3.7% respectively. They now have 13.4% and 8.7% of the market each. Co-op’s share stands at 5.8%, while Waitrose accounts for 4.4% of the market. Frozen food retailer Iceland saw an increase in sales of 3%, while Ocado’s sales surged 12.1%, holding its market share steady at 1.7%.