Household Bills

PM rules out tax cut pledge but says ‘economy healing’

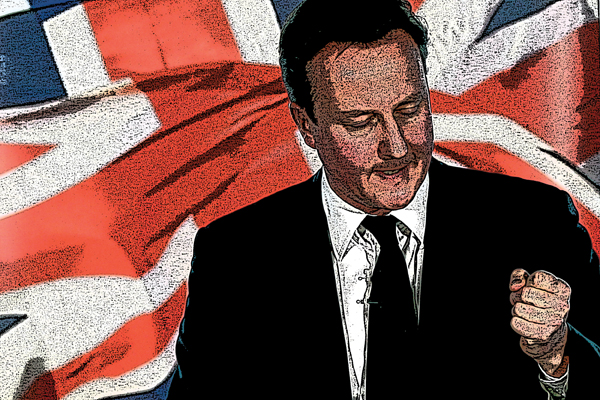

David Cameron has refused to rule out future tax rises but says his overall aim is to “give people back some of their hard earned money” as economic conditions improve.

Cameron said no leader could give “blanket assurance” on tax increases but added reducing people’s taxes was what “drives” him as a Conservative, the BBC reports.

The comments come after Chancellor George Osborne recently said further tax rises would not be necessary after 2015. Osborne also said the Conservative Party’s approach on tax would differ from both Labour and the Liberal Democrats.

Speaking on the BBC’s Andrew Marr show the PM said the coalition had struck the right balance between spending cuts and tax rises. And backed the Chancellor’s position on tax hikes after 2015.

However, he added: “No prime minister can ever give blanket assurance about every single thing under the sun.”

“I am a low tax Conservative. I think as we start to see the economy healing – and it is healing – as we see the country improve, actually I want to give people back some of their hard-earned money and try to reduce their taxes.

“That is what drives me as a Conservative. I think your economy does better if you say to people you have worked hard, you have done the right thing, here is some of your own money back in a tax reduction,” Cameron said.