Insurance

REVEALED: How your postcode and your car insurance premiums are linked

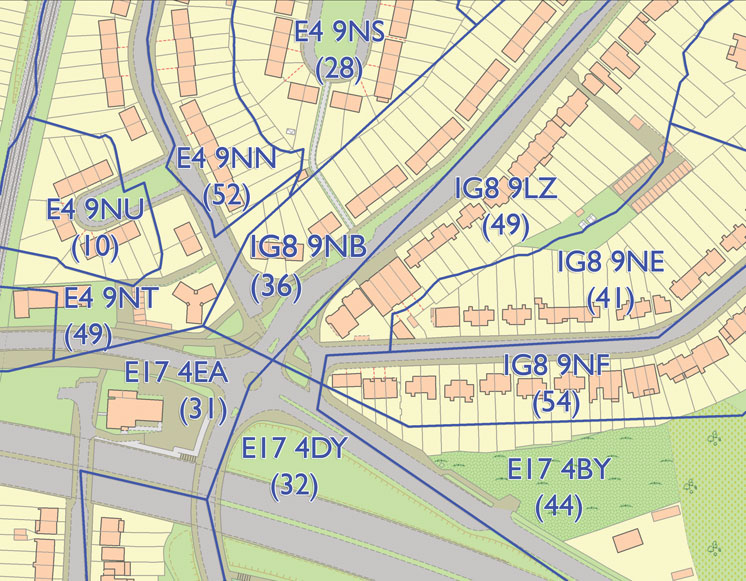

A decline in average car insurance premiums masks big regional differences, according to research by AA Insurance.

While the average quoted Shoparound premium for an annual comprehensive car insurance policy fell by 6.1 per cent over the three months ending 30 June 2014 – and 19.3 per cent over 12 months – the AA’s Index highlights extreme differences between postcodes.

In London, for example, the average premium quoted was £922.44, while on the Isle of Man the average quote was just £231.49. The cheapest mainland postal area for car insurance was the south-west of Cornwall, where the average quote was less than a quarter of what Londoners paid at £279.72.

According to Janet Connor, managing director of AA Insurance, car insurers consider a range of factors besides the experience and age of the driver and the model of the car when they calculate premiums, including where the car is likely to be kept for long periods of time.

She said: “The premium reflects the likelihood of a claim being made and, in some urban areas, there is much greater risk of a collision taking place or of car crimes such as theft of or from a vehicle, uninsured driving or attempts at a ‘cash for crash’ fraud. Sadly, the criminality of some people has a detrimental effect on the premiums paid by honest motorists in such places.”

According to Connor there is some hope as, on average, areas of the UK that have traditionally paid the highest prices have also seen the largest drops in their premiums. The average Shoparound premium in London fell five per cent this quarter, for example, while in Manchester it dropped by 4.1 per cent over the same time period.

Why Life Insurance Still Matters – Even During a Cost-of-Living Crisis

Sponsored by Post Office

See the charts below to find out if your postcode is amongst the most or least expensive places to in the UK to insure a car.

Five most expensive postcodes in which to insure a car

| Cheapest to most costly | Postcode Area | Average Shoparound Premium | Quarterly Fall/Rise |

| 1 | IM (Isle of Man) | £231.49 | -3.3 per cent |

| 2 | KW (Kirkwall) | £252.13 | -1.9 per cent |

| 3 | TR (Truro) | £279.72 | -1.8 per cent |

| 4 | AB (Aberdeen) | £285.82 | -0.5 per cent |

| 5 | DT (Dorchester) | £286.26 | -1.9 per cent |

Five cheapest postcodes in which to insure a car

| Most expensive to least expensive | Postcode Area | Average Shoparound Premium | Quarterly Fall/Rise |

| 1 | London (All postcodes) | £922.44 | -5 per cent |

| 2 | IG (Ilford) | £912.07 | +4.5 per cent |

| 3 | M (Manchester) | £820.63 | -4.1 per cent |

| 4 | UB (Southall) | £807.11 | +3.6 per cent |

| 5 | OL (Oldham) | £794.78 | -7.2 per cent |

Source: AA British Insurance Premium Index