Experienced Investor

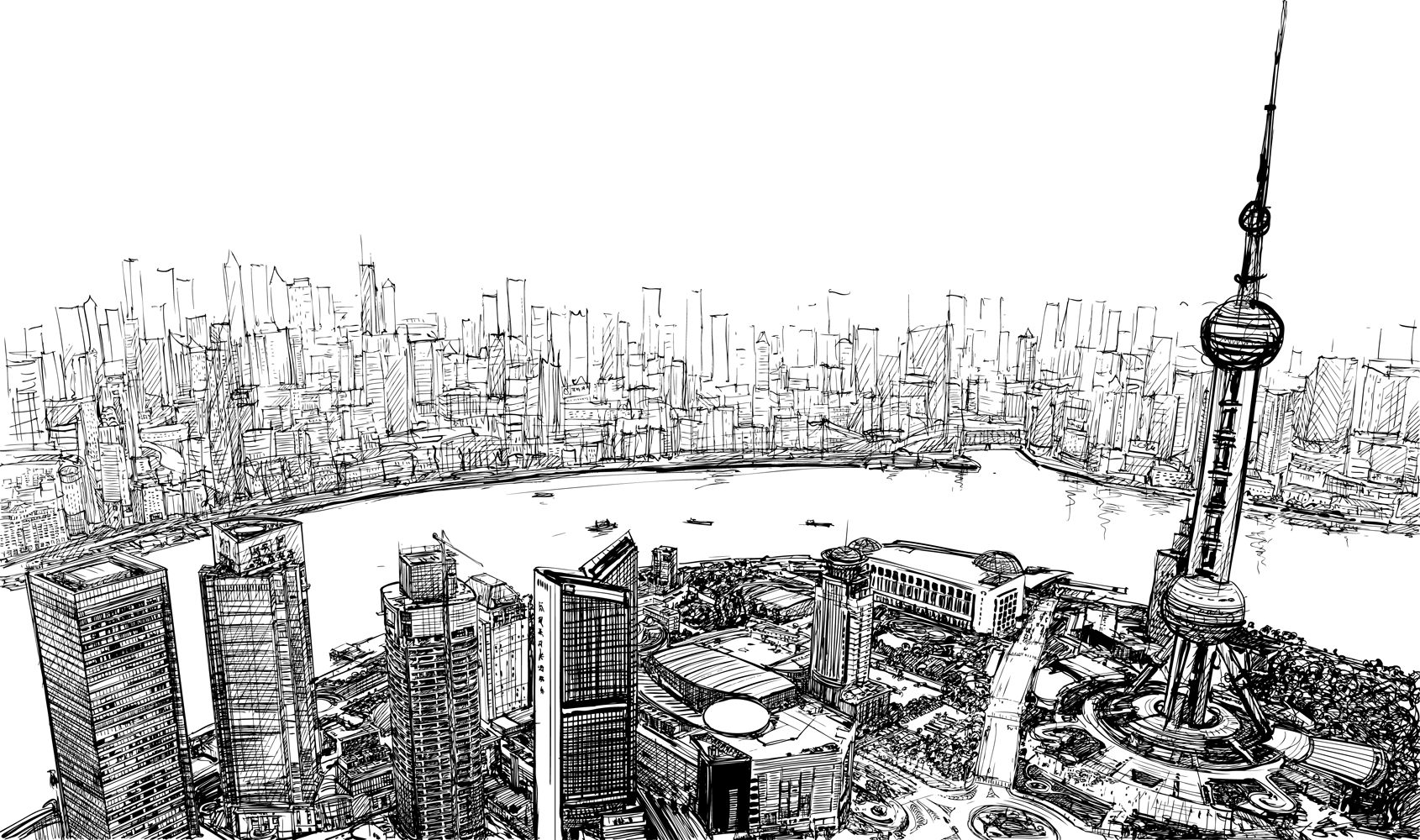

Around the world in funds – Emerging Markets

It’s a week for adventurous investors as we explore the best funds that emerging markets have to offer.

Tom Stevenson finds the ‘emerging markets’ umbrella far too broad – but that doesn’t stop investors from using it, he says.

Stevenson says: “The various countries that fall within this category experience different macro-economic conditions, have different degrees of reliance on exports and domestic consumption and, crucially, are valued by investors in different ways.

“It is worth emphasising the importance of both diversification – you don’t know what’s going to be up and what down in the months ahead – and stock-picking. The dispersion between winners and losers in many of these markets is wide.”

In this region Stevenson likes the Fidelity Emerging Markets fund, the JPM Emerging Markets fund and the Threadneedle Global Emerging Market Equities fund.

He says: “Irina Miklavichich, who runs the Threadneedle fund, and her team conduct a large number of meetings with company management. Global themes also provide the impetus behind investments and the investment team looks for companies which demonstrate good growth prospects for the medium-term.”

Ben Yearsley of Charles Stanley and Darius McDermott of Chelsea Financial Services both tip the Lazard Emerging Markets fund.

Yearsley says: “The management team, headed by the experienced James Donald, focuses on companies that are financially produced yet inexpensively valued. They are also conscious of the many political and economic risks inherent in investing in emerging markets when constructing a portfolio.”

McDermott sees fundamental reasons why emerging markets are attractive in the long-term – including growth above developed economy rates and favourable demographics – he sees conditions remaining turbulent in the short-term and is yet to be convinced that there is a catalyst for the region’s fortunes to reverse.

Nevertheless, he says, valuations suggest it may be a good entry point.

McDermott likes the M&G Global Emerging Markets fund and the Aberdeen Latin America Equity fund.

Mona Shah of Rathbones prefers the Genesis Emerging Markets Investment Trust.

She says: “This fund sold off because of geopolitical tensions and is now looking like good value on a discount of 6 per cent. Although the geopolitical uncertainty remains, we like the trust because it is more focused on bottom-up fundamentals. The discount potentially provides an entry point for long-term investors.”

For his part, Gavin Haynes of Whitechurch Securities likes the JPM Emerging Markets Income fund. He says: “We also have exposure to the GAM Star China fund.”

Next week we’ll be ending our trip around the world close to home, taking a look at the best funds that Europe has to offer.

To see last week’s Japanese fund picks click here.