Household Bills

Autumn Statement 2013: Everything you need to know

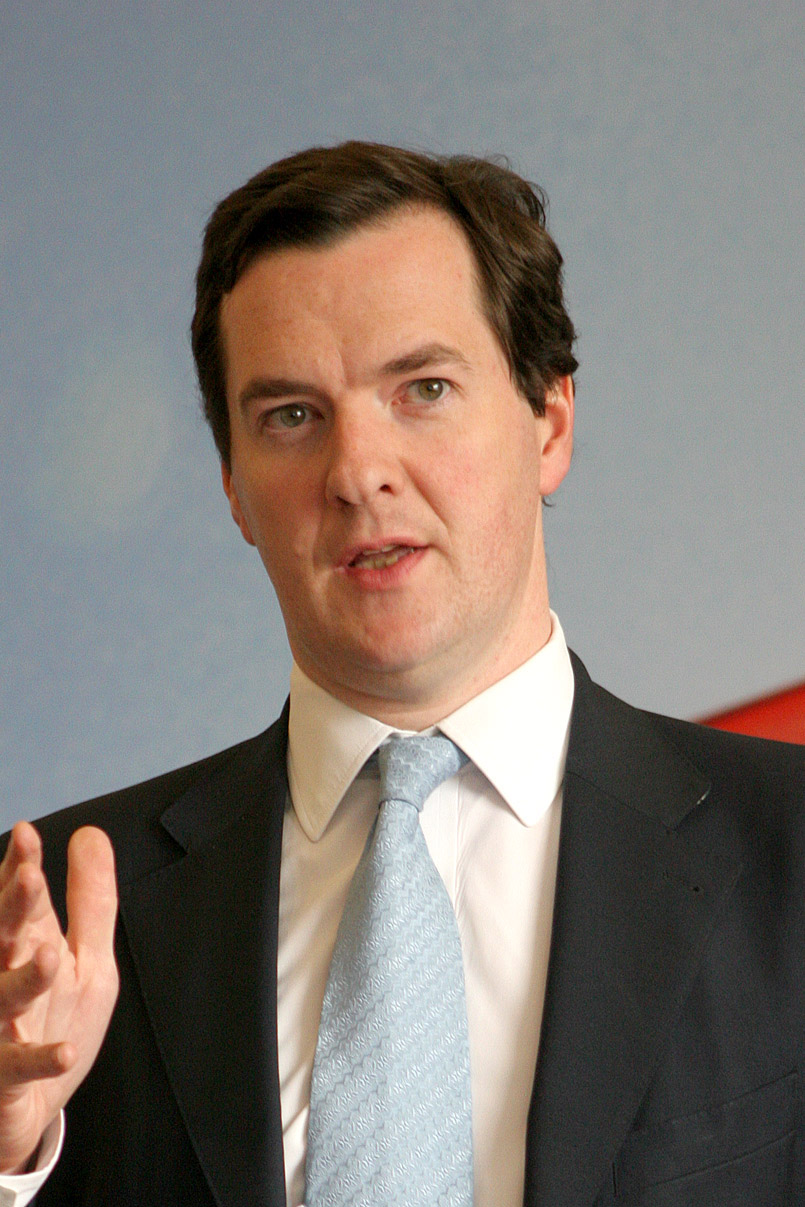

George Osborne presented his 2013 Autumn Statement to the House of Commons this week, declaring Britain is on the road to economic recovery.

Here, we outline the key measures relevent to you and your finances…

Pensions

This was the big one (and therefore the one that made the newspapers ahead of the statement): The increase in state pension age to 68, which had been scheduled for the mid-2040s, could come forward to the mid 2030s, while the increase to 69 could come as soon as the late 2040s. These changes are not set in stone, but are rather an expected consequence of the coalition’s ‘guiding principle’ that people should expect to spend, on average, up to a third of their adult life in receipt of the state pension.

The basic state pension will be increased in line with the triple lock in April 2014 – the higher of average earnings growth, inflation or 2.5%. This represents a cash increase of £2.95 per week for the full pension.

The government will not change the basis on which GAD tables are formulated. It had commissioned its actuary’s department to review income drawdown tables to ascertain if income drawdown rates are a reasonable match to annuity rates.

ISAs

The government will uprate the ISA, Junior ISA and Child Trust Fund annual subscription limits in line with CPI. The 2014-15 ISA limit will be increased to £11,880 (half of which can be saved in a cash ISA). The Junior ISA and Child Trust Fund limits will both be increased to £3,840.

Why Life Insurance Still Matters – Even During a Cost-of-Living Crisis

Sponsored by Post Office

Tax

From 2015-2016, spouses and civil partners will be able to transfer £1,000 of their income tax personal allowance to their spouse or partner, permitted neither individual is a higher or additional rate taxpayer. The transferable amount will be increased in proportion to the personal allowance.

Non-residents disposing of UK residential property from April 2015 will be charged capital gains tax on any gains made from the sale.

Tax avoidance

The government is to increase both the obligations and sanctions on high-risk promoters of tax avoidance schemes by introducing objective criteria for identifying and publishing the names of high-risk promoters. It will also seek more information from them and apply penalties where there is failure to comply.

It will also introduce a new power requiring taxpayers who are using avoidance schemes that have been defeated through the courts to pay the amount in dispute with HMRC upfront.

Help to buy

Challenger banks Aldermore and Virgin Bank are to start offering Help to Buy mortgage guarantee products later this month. The two lenders had previously indicated they would join the scheme from 2014 but both will now launch before the New Year.

Aldermore will launch its products on Monday 16 December with Virgin Money expected to follow.

Fuel

The government is to freeze fuel duty until the next general election.

George Osborne cancelled a 2p-a-litre rise which was due to come into force next September. Fuel duty will remain at 57.95p per litre – where it has been since March 2011 – for the remainder of this parliament.

Rail fares

Rail fares in 2014 will be capped in line with inflation, complementing the decision by the Mayor of London to cap average fare increases in London for 2014.

Other bits…

ETFs

From April 2014 the government will remove the stamp duty and Stamp Duty Reserve Tax (SDRT) charge on purchases of shares in ETFs that would currently apply if an ETF were domiciled in the UK.

NICs

The government will abolish employer NICs for those under the age of 21 from April 2015, with the exception of those earning more than the Upper Earnings Limit, which is £42,285 a year (£813 per week) in 2015-16.

Property tax

The government will cap the RPI increase in business rates at 2% for 1 year from 1 April 2014.

Equitable Life

Quick update here: Payments of £5,000 due to people who bought with-profits annuities from Equitable Life before September 1992 will mostly be made straight into policyholders’ accounts.