Blog

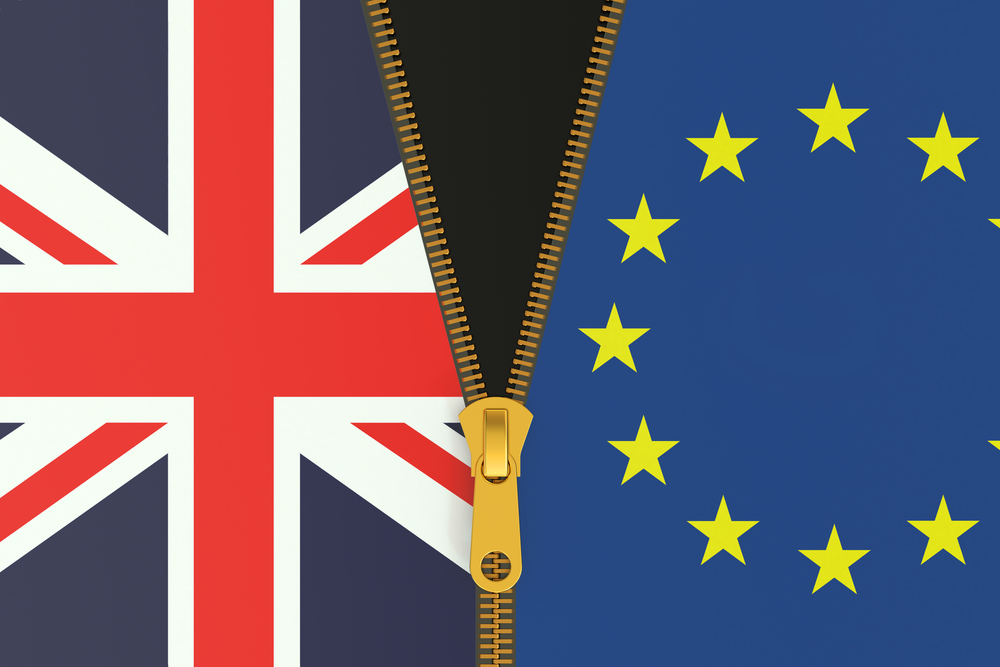

BLOG: Brexit could be a golden opportunity for fund managers

Investor sentiment in the UK is at a record low since 1995 – worse than during the Global Financial Crisis.

This negative environment has reshaped the market, derating businesses across the board. However, pessimism can be advantageous to long-term active managers, creating opportunities to pick up high-quality growth companies at attractive valuations.

Inflection points, where investors exercise excessive caution, help bring about those opportunities because they bring volatility to the markets. For the active manager who has put in months or even years of forensic company research and engagement in order to uncover their next investment idea, these inflection points are the perfect opportunity to establish those new positions at a more attractive price point. Brexit may prove to be an example of this.

Brexit bounce?

Ultimately, the UK domestic stocks currently so unpopular with investors will rerate, barring unrelated company-specific headwinds. And sentiment could flip quite quickly – any guarantee of medium-term certainty would boost markets, rewarding small and mid-caps where growing dividends and room for capital growth can be found. Our job is to make sure we buy in before this happens, so we are in a position to benefit from the eventual turnaround.

Broadly, we remain positive on the year ahead, despite potential bumps along the road. We continue to be focused on identifying high quality growth businesses with good cashflow, strong margins and returns on capital. These qualities are the first thing we look for, before we consider an appropriate valuation.

One company we have been monitoring for some time was Gooch & Housego, a global leader in optics and photonics technology.

It is one of only a few high-tech firms in the world to manufacture lenses for specialist applications and lasers. Despite its market-leading position in this niche industry and a strong management team, the company has become unloved in the last six months for no reason other than poor sentiment in UK small and mid-caps. We have now started to build a small position, taking advantage of such short-termism.

Golden opportunity

There will always be political uncertainties to contend with, of which Brexit is one, however most of our holdings are international players with diversified exposures. For these companies, the UK market is relatively small, and potentially bigger problems such as President Trump’s trade tariffs and political uncertainty in Europe are of greater concern. Moreover, if the pound comes under pressure, exporters will be rewarded.

Phil Harris is portfolio manager of the EdenTree UK Equity Growth fund