Investing

Gangnam Style, movies and botox: Asia’s investment themes

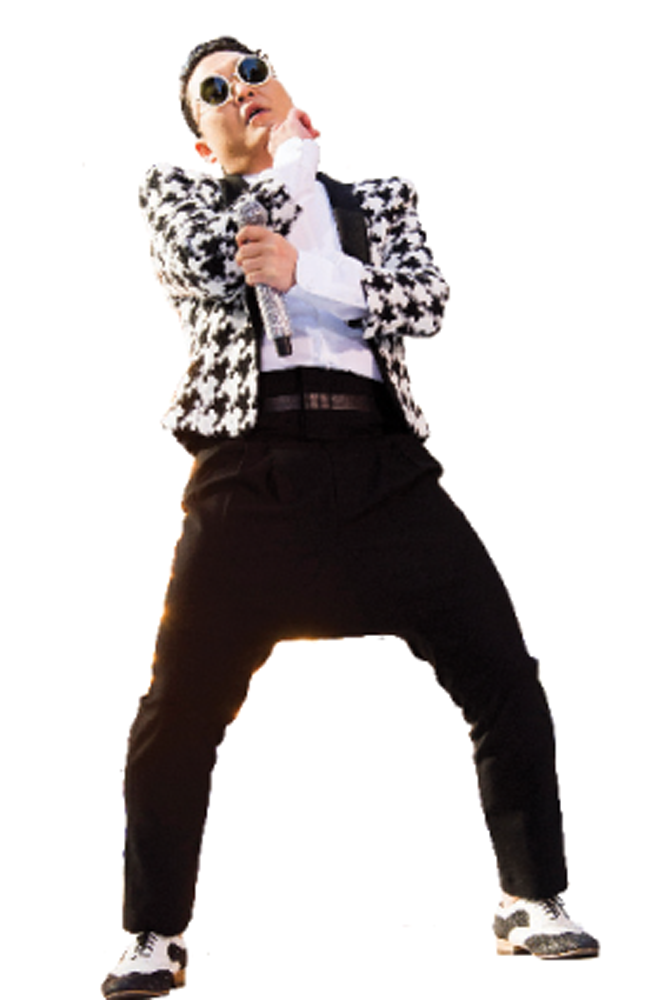

Before South Korean singer Psy burst onto the UK music scene with infectious hit Gangnam Style, few people had heard of K-pop, or Korean pop music.

But all things Korean are hot in Europe at the moment, as the Western world catches on to what the rest of Asia has known for a long time – Korea is a creative centre of culture in the ASEAN (Association of Southeast Asian Nations) region.

As disposable incomes have risen and there are increasing options for low cost travel between countries in Asia, consumers have been flocking to the most exciting cultural centres to spend their cash.

The consumer story in Asia has moved on from the Chinese luxury goods theme – if you want to tap into the real growth, you need to look further down the cap scale at those companies helping people fill their leisure time.

This is the view of Heather Manners, founder of boutique Prusik Investment Management, and manager of the firm’s Asia and Asian Smaller Companies funds.

She is taking advantage of the leisure theme through a number of stocks, including a major Thai cinema chain, Korean firm Interpark which sells tickets to concerts and other events, and Thai tour company Minor International.

“Korea is a cultural centre – anything to do with film, theatre or music is being devoured by the Asian consumer,” she said.

Shopping is also evolving in the ASEAN region, with local brands gaining traction through hypermarkets, malls and other retail chains. This will be a key growth area for years to come, according to Manners. “Anyone who tells you they have got Asia consumption sewn up because they own Nestlé and Unilever should think again,” she said.

She owns a Korean small-cap company called KTIS which ties in to the retail theme.

The firm has developed an automated system to refund VAT rebates to shoppers crossing the borders between countries, who would otherwise face lengthy queues. The stock trades on four or five times earnings and Manners said the share price could double from here.

Preconceptions

When investors think of Asia, China tends to be the first thing on their mind, although the powerhouse economy has seen its explosive growth rate slow, and recent data from the country has been mixed. However, Manners said there is so much more to the region that investors are missing.

“Asia is not China. China is not the be all and end all – it dominates people’s thinking because of its size. Get your map out and look at the rest of the region, that would be my advice to investors. People need to throw out their preconceptions about Asia.”

Following a recent trip to the region, Manners is more convinced than ever about the potential that exists there, especially in Korea, with the huge popularity of its makeup brands, cosmetic treatments, TV soap operas and fashion labels.

“Korea is linked into our culture with Gangnam Style and so on, but people do not really understand the country. There is so much creativity there which they have not had up until now, and it is becoming increasingly important,” she said.

Beauty

The beauty industry is also presenting interesting investment opportunities, as Korean women are increasingly willing to spend their cash on procedures and potions to make them look like Hollywood starlets.

Manners owns local makeup brand Missha and previously held Medytox, a producer of the main ingredient in botox, and regrets selling this too early.

These types of companies tend to be small, with a market cap of between $150m and $1bn, but Manners aims to spread risk by ensuring no more than 20% of the fund is held in the least liquid stocks which would take more than two days to sell.

She added investors should consider actively-managed strategies to access these niche areas, and ASEAN more generally, since ETFs tend not to give proportionate coverage of the best performing markets in the region.

For example, the Philippines makes up just 1% of the ASEAN index but Manners has a 17% allocation to the country in her Prusik Asia fund because she sees exceptional opportunities there.

Risks

So, the evolving consumer story in ASEAN certainly looks interesting, and Manners makes a convincing argument, but what are the risks?

A key thing to consider is the supply and demand dynamic of the market, Manners said. “It is not that people have stopped buying luxury goods, there is just more choice.”

She gave the example of the boom in sportswear brands in China – this was seen as a subsector with a bright future a few years ago, and many foreign investors rushed to back this trend.

However, more and more local sportswear brands flooded into the market and, before long, there was oversupply.

“It was difficult to predict which company would do well. There was no scarcity value, and they were hard to invest in. You have to look at supply in these markets,” Manners added.

Certainly, the face of Korean pop, YouTube superstar Psy, is riding the wave of success with the release of his second single last month.

As the juggernaut of Asian spending power rolls on, time will tell if the Korean cultural revolution can also go from strength to strength.

Geographical allocation – Prusik Asia fund

Asset allocation by theme – Prusik Asia fund