First-time Buyer

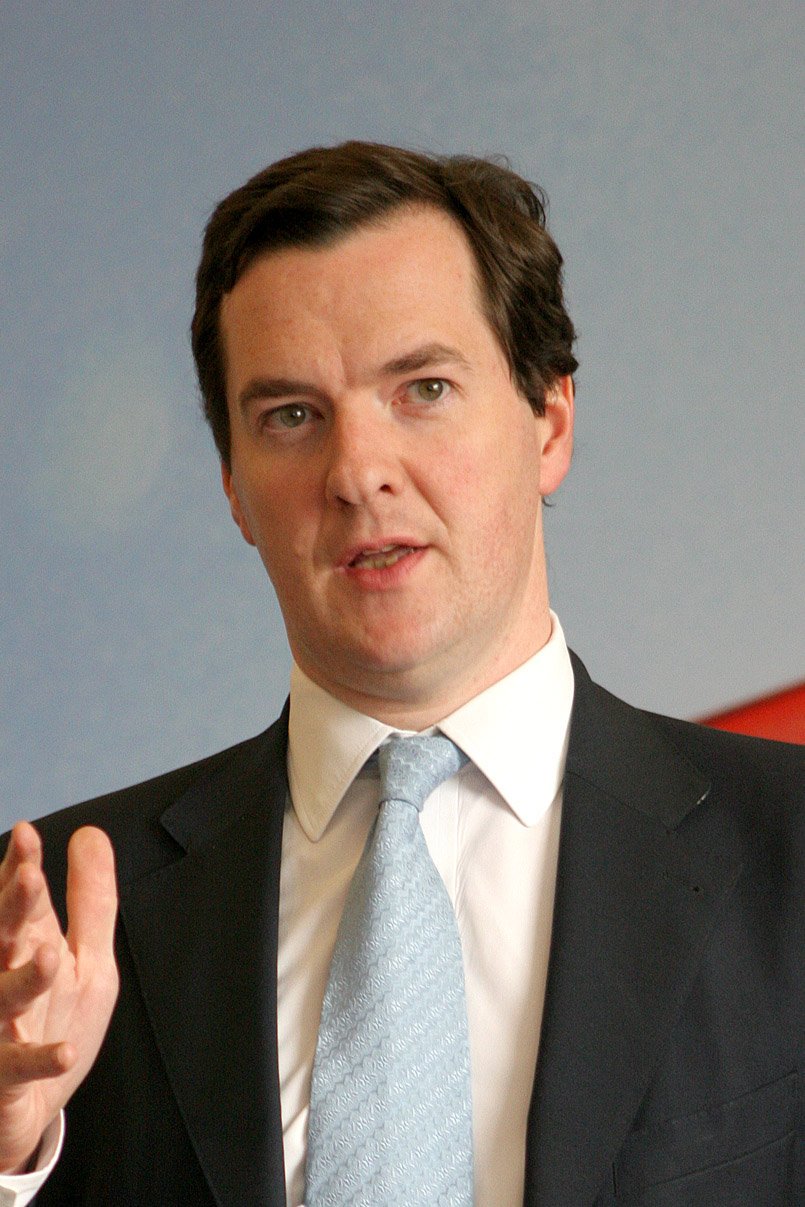

Osborne to launch London Help to Buy scheme

George Osborne has announced he will create a London Help to Buy scheme to address the housing crisis in the capital.

In his Autumn Statement, the Chancellor said Londoners with a 5% deposit with be able to get an interest-free loan worth up to 40% of the value of a newly-built home.

The Chancellor said the government was choosing to build homes that people can buy.

“For there is a growing crisis of home ownership in our country. Fifteen years ago, around 60% of people under 35 owned their own home, next year it’s set to be just half of that,” he said.

The housing budget is set to be doubled to over £2bn a year which will help the government deliver 400,000 affordable new homes by the end of the decade.

He said almost half of these homes would be Starter Homes sold at 20% off the market value to young first-time buyers. Some 135,000 will be under the new Help to Buy: Shared Ownership scheme.

It plans remove many of the restrictions on shared ownership relating to eligibility and who they can be sold to.