Buy To Let

Developers use Government schemes to downplay asking prices

Property developers are using Government help for buyers to market new build houses at 80% of their actual price.

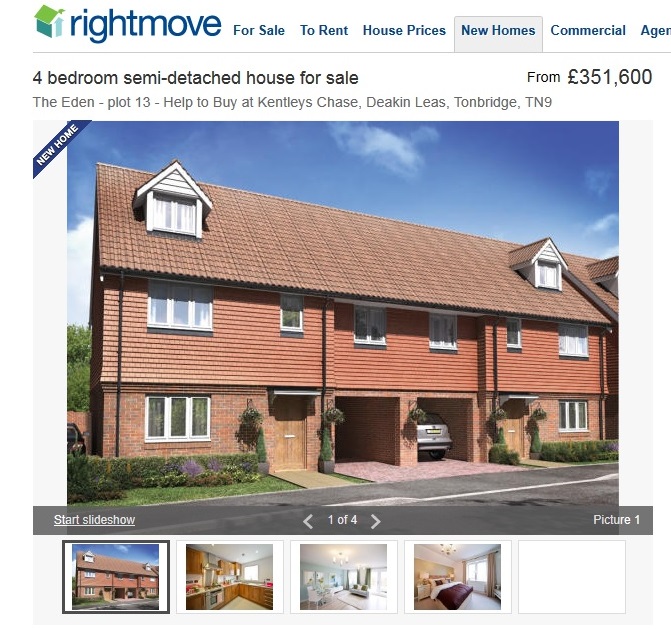

In one Rightmove newsletter, Taylor Wimpey advertised a new build property in Tonbridge with a price starting at £351,600. However, smaller print below explained the figure had a 20% FirstBuy equity loan deducted.

In a separate advertisement in the same newsletter, the same property was priced at £439,500 for all other non-FirstBuy purchasers.

Such tactics would appear to substantiate fears expressed by critics of the Government’s new home schemes, who assert that subsidies for buyers, in the form of interest-free equity loans for up to 20% of the property’s value, could inflate new-build property prices.

Mortgage advice firm First Xtra managing director Chris Hall said: “These Government schemes are definitely good for the whole property market because they are getting people thinking about buying, but they do not always seem to be so great for the end customer. Sometimes builders may be inflating prices.”

The average house price of new build property in the UK has increased by 12% over the past five years with the average price now at £233,822, according to Halifax.

A Rightmove spokesman said other developers use similar marketing methods.

A Taylor Wimpey spokeswoman said the property above had been marketed to reflect the two different methods of purchase available and the deduction of the 20% equity loan was a clear caveat.

She added: “Listing on online portals in this way enables customers to find the property in price related searches. This method is employed across all Taylor Wimpey properties where such incentive schemes are available to house hunters.”

In another example, Bloor Homes advertised a new build home in Silsoe as shared equity at a headline price of £440,000. However, according to the small print the full price is £550,000 and the deduction is based on the Help to Buy 20% equity loan.

Bloor Homes South Midlands sales director Luke Southgate said Help to Buy was clearly mentioned in the paragraph next to the photo and could help raise awareness of the scheme: “If you have a property that is £100,000 but under Help to Buy is £80,000, someone who has only got a budget of £80,000 will never know it’s available on Help to Buy because they’ll never see it advertised.”

He said encouraging house hunters to buy at a higher price was the whole point of the scheme: “The Home Buy Agencies encourage people to buy at a higher price. For example, if I wanted to buy that house but it was deemed as too affordable for me, i.e. I’ve got too much deposit and the monthly payments are too little, they would encourage me to find a more expensive house. That’s how it works.”