Enquiries to quick home buying and selling firms have soared amid the cost-of-living crisis as financially struggling, equity-rich but time-poor owners look to dispose of properties at pace. But in an unregulated industry, here’s what you need to know before handing over your keys.

Homeowners and landlords are selling more than £2bn worth of property a year to firms guaranteeing to snap them up quickly if they forfeit a chunk of their equity in return.

Rising interest rates, the ongoing cost-of-living crisis and a slow housing market has led some firms to report a rise in enquiries from owners who are prepared to lose tens of thousands of pounds to sell their home fast.

They could sell in a matter of days or weeks rather than months. Sellers are also tempted by firms which cover legal fees, deal with the paperwork and ultimately, take a problem property off their hands.

While a number of quick home selling firms are voluntary members of industry trade body The National Association of Property Buyers (NAPB) which sets out a code of conduct, it is an unregulated industry, with sellers warned to “be vigilant”.

An exclusive YourMoney.com investigation reveals some of the underhand tactics used such as slashing the cash offer just as the property is about to be sold, deducting hidden fees from proceeds, while others masquerade as cash buyers when in fact they’re a broker.

If you are considering selling your property to a quick homebuying company, our guide explains how they work, the pros and the pitfalls, plus tips and checks when it comes to choosing a firm.

How do quick home selling firms work?

After completing an enquiry form on the company’s website you’ll be contacted swiftly to answer some questions about your home’s condition and any improvements you’ve made. The company should outline the discount to market price you can expect.

If you proceed, some firms will ask two estate agents to assess your home’s value. Others use computer software to research recent valuations and sold prices of similar properties. Next the company makes a cash offer which is typically 15% to 20% below the market value for your home.

If you accept, the company will instruct a chartered surveyor to carry out a thorough inspection to check the property condition and any structural issues. At this point the offer could drop even lower if the property is in a worse condition than you described.

The company instructs a conveyancer to complete the legal work and sets a date to complete your sale. According to industry body NAPB, you should receive the cash – at the offer agreed – within one day of completion.

Who tends to use quick home selling firms?

Cash buying firms are often used by landlords looking to exit the market. The sale can be timed for the day after the tenancy expires. We Buy Any Home says it has seen a 20% year-on-year uplift in landlords offloading properties.

Owners who have inherited properties who have already waited around nine months to be granted probate, as well as households in financial difficulty, divorcing couples, or sellers who want to stop their property chain from collapsing also turn to these firms.

As with usual property sales, all parties named on the land registry as owners must agree.

Meanwhile, downsizers with significant equity also look to quick home buying companies. Fast-selling company Gaffsy says it has seen a threefold increase in enquiries since the cost-of-living crisis began.

However, the firms can’t help if you want to sell a property which is in negative equity as the price offered must be enough to clear your mortgage in full.

Those in shared ownership property are also unlikely to be accepted because the discounted offer would have to be enough to cover your mortgage and pay back your lender in full.

Why use a quick homebuying firm?

They guarantee to buy your home in a matter of days or weeks to meet your deadline. They also make it easy to sell your home which can be a lifeline for owners with problem properties.

Firms such as Gaffsy will buy buy-to-let homes with sitting tenants and properties with cladding, subsidence, or structural issues. Most companies will buy homes with a low term remaining on the lease but some will not buy listed homes, properties above commercial premises or properties worth more than £500,000 because they are too expensive to purchase.

Also bear in mind, the tougher your home is to sell, the bigger the discount you’ll be offered.

As an example, if the seller doesn’t have planning permission for a loft conversion or extension, that wouldn’t necessarily prevent the firm from buying the property, but it would value the home as if that room did not exist or the offer would be based on its original use, pre-conversion.

‘We knew we had to do something drastic’

Former professional landlords Martin and Angela Wingrave accepted a cash offer £43,000 below the market value from Open Property Group.

With their hearts set on retiring to Brittany, northern France, Martin, 68, from Plymouth, needed to sell his last remaining property so they could buy their dream home. After losing the last buyer when mortgage rates rocketed in October 2022 the couple decided to contact a professional cash buyer.

“We had 75% of the money to buy the house in France from the sale of our other lets and didn’t want to borrow any money so we knew we had to do something drastic,” Angela, 72 says.

Martin’s three bed terrace in Exeter had been valued at £235,000. He was offered £192,000 from Open Property Group. Their legal fees and a £3,500 exit fee to the couple’s estate agent were paid by the firm.

“I didn’t realise I’d have to drop the price as much as I did but they guaranteed to give us the money within our timescale of seven weeks,” Martin says. “The draw for us was the certainty to get a done deal within our timeframe so we were prepared to take the hit on the price and were in a position to do so.”

Angela adds: “It worked for us and the company was very professional and honest but do your research, there are a lot of sharks out there.”

It took the company four months to achieve the market value of £235,000 – time that the couple didn’t have to buy their dream home overseas.

Discount to market value with prices slashed further

Sellers must accept a discount of around 15% to 20% of the market value. The discount covers legal fees, higher level stamp duty payable when buying a property that isn’t a main home, business overheads and marketing costs to re-sell it. The firm must also consider the cost of holding the property for a number of months which includes insurance and council tax, with the goal of making a profit.

A common complaint is that companies reduce their initial offer. Jonathan Rolande, chairman of NAPB, says this can be because the owner did not disclose serious issues that were picked up later by the valuation.

Paula Higgins, chief executive of consumer group HomeOwners Alliance, says she has received letters from homeowners who had their offers slashed at the last minute. One seller had been offered £200,000 but just before the sale – and after they had been encouraged to move out – the offer was reduced to £130,000.

“Often people are in a vulnerable position and are looking to sell their property very quickly,” she says. “Be really careful that the price the firm says it will pay is the real price. Don’t feel pressurised to accept a lower offer. Consider property auctions as an alternative.”

A lack of transparency is also a problem among some companies. YourMoney.com approached 14 companies to ask how they operated but only six responded, two declined to answer and six failed to respond.

Here is the list of firms contacted, whether they responded, plus if they’re a NAPB member:

- We Buy any Home: Responded, member of NAPB

- UK Homebuyers: No response, member of NAPB

- Good Move: No response, member of NAPB

- Open Property Group: Responded, member of NAPB

- National Homebuyers: No response, not a member of NAPB

- Quick Move Now: Responded, member of NAPB

- Housebuyers 4u: Declined to answer “commercially sensitive questions”, member of NAPB

- Webuyanyhouse.co.uk: No response, not a member of NAPB

- House Buy Fast: Responded, member of NAPB

- Yes Homebuyers: No response, member of NAPB

- Property Rescue: Reply only if we linked back to its website, member of NAPB

- Upstix: Responded, member of NAPB

- Smoothsale: No response, member of NAPB

- Gaffsy: Responded, member of NAPB.

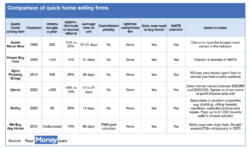

The table below provides a comparison of the six quick home selling firms which responded to our enquiry (click to expand):

Not all companies are genuine cash buyers. Instead, they’re secretly a middleman saying they’ll buy your home while planning to find an investor or buyer in the background. You’ll still be offered a heavily discounted price but will not get a quick sale.

Rolande said underhanded practices must not be carried out by members of the NAPB because they must adhere to a code of practice.

Member conduct is policed by independent redress organisation The Property Ombudsman (TPOS) which has the power to award compensation. Between 2020-2023, it closed 19 cases concerning residential property buying companies, with the most common complaint relating to the offer price changing after a valuation or conveyancing had been carried out, followed by complaints that the process hadn’t been as quick as the sellers anticipated.

Of these 19 cases, 15 resulted in awards with the average value of £834, while the highest award was £5,000 for a case where there was a dispute about the leasehold of a property which affected the value the parties had agreed.

What should you watch out for?

Make sure you know how your company operates. Gaffsy, for example, make their final offer after the chartered surveyor’s visit. Quick Move Now make their formal offer after two independent estate agent visits. The surveyor’s visit is to check the condition is satisfactory, the company says.

Be wary of documents you’re asked to sign before you exchange contracts to sell. You could get tied into a service agreement which stops you using another company for a specified time period.

Do not use a company that refuses to issue a formal offer in writing (email is fine) along with fees and charges which could reduce the amount of cash you receive. Do not accept a verbal offer. Ask the company if there’s a penalty to change your mind. Some companies will charge you an exit fee for backing out after a valuation or legal work has started.

Always instruct your own solicitor to review the sale contract and any documents you’ve been asked to sign before putting pen to paper.

Most firms will pay all your legal fees if you use their conveyancer which they say speeds up your sale. However, you will not receive advice from a conveyancer on whether you should proceed. Some companies will contribute to your costs if you instruct your own solicitor. Open Property Group, for example, will pay up to £1,200.

Never sign paperwork you don’t understand. It can have dire consequences.

In one extreme example of bad practice seen by Trading Standards, a couple didn’t understand that the paperwork they had signed was a power of attorney giving the company the power to make decisions about their home before they sold it. The firm instructed expensive repairs and upgrades to be made to the property before it was sold which were paid for out of the owners’ proceeds. They ended up with little money left after the sale.

Alison Farrar, operations manager at National Trading Standards Estate and Letting Agency Team, says: “If you’re thinking of selling your home in this way, we urge you to be vigilant. While the majority of ‘quick sale’ agents are operating responsible and legitimate businesses, there are some agents who break the law and deliberately mislead sellers. This includes failing to transfer proceeds of the sale on time, reducing the sum of the sale with hidden fees or not actually selling the property at all.”

Tips when choosing a company

Always choose a company that is a member of the NAPB. Read reviews from verified users on Google Reviews, Trust Pilot or Yell.com.

Avoid any company that has aggressive sales practices such as badgering you by email or phone to accept their offer.

Research the value of your home before you approach the cash buyer. Get your own valuation report from a RICS chartered surveyor or ask two independent estate agents for their view.

Property expert Dave Sayce, managing director of Compare My Move, adds: “If you’re asked to pay a fee upfront or a cancellation or withdrawal fee, look elsewhere. Most companies will only take a fee from the house sale. Look elsewhere if the company promises a high offer for your property.”

If you suspect you have been a victim of fraud, have been misled by the company or have suffered aggressive sales tactics contact the Citizens Advice Consumer Helpline on 0808 223 1133.

If your company is a member of the NAPB you can also complain to The Property Ombudsman.

Capital Gains Tax and high deposit protection

If the cash you deposit in your bank or building society account is more than £85,000 your balance will still be protected under the Financial Services Compensation Scheme (FSCS) if the institution fails. However, this is only applicable if the proceeds were from the sale of your main residence. Temporary high balance protection for sums up to £1m lasts for six months from when the money was deposited. Landlords or sellers of second homes are excluded. They will, however, still be protected under the standard £85,000 limit.

A landlord who is a basic rate taxpayer will pay 18% Capital Gains Tax (CGT) on the overall gain made on the property above the annual exemption of £6,000 (£3,000 for trusts). This could rise to 28% depending on the size of your gain, your taxable income and amount above the basic rate. Higher rate taxpayers pay 28%. By selling your property at a discount to the cash buyer your CGT tax liability will be lower or could be wiped out. Landlords have 30 days to pay their CGT tax bill.