Santander is to increase the interest rate on its 123 cashback credit card in December – the first time in six years – to “reflect increased costs”.

Depending on the individual interest rate applied to you, you won’t pay more than 23.9%. Those already charged 23.9% won’t see an interest rate hike in December.

As an example, if you’re currently charged 20%, your rate won’t increase by the full five percentage points (to 25%) as it will be capped at 23.9%.

In the letter to customers, Santander also explained that if you don’t want to accept the changes and want to close the account, you need to inform the bank by 8 December 2023.

If you choose this option, you can pay back your balance over time (not by the 8 December deadline) at the existing interest rate, but:

- You won’t be able to use your card for further transactions

- You’ll need to cancel any regular payments and subscriptions that you make on this credit card

- Any additional credit cards connected to this account will also be blocked

- Your account will be closed once you’ve cleared the outstanding balance.

Santander wrote: “We’re increasing your standard interest rates to reflect the increased cost of providing your credit card.

“We’re fully committed to supporting you during these changes. If you feel that the proposed changes would create financial hardship, or if you have concerns about your ability to manage these changes, please reach out to our dedicated customer support team on 0800 389 6655 or log on to Mobile or Online Banking and use ‘Chat with us’ or visit your local branch.”

A spokesperson, added: “Due to changes in the economic environment, including the Bank of England base rate increasing by more than 5%, we are increasing the interest rate charged on our credit cards from 14 December 2023. This is the first rate change for our customers in six years and any increase is capped at a maximum of 5%.”

Credit card interest rates on the rise

According to Fairer Finance, the average APR has risen by about 1.8% in the last year, and Santander isn’t alone in revising rates (all of its credit cards except the World Elite card will have rates increased).

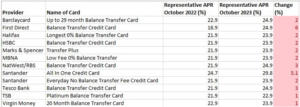

The consumer group and ratings provider revealed that a host of credit card providers have hiked rates for borrowers over the past 12 months:

James Daley, managing director of Fairer Finance, said: “Interest rates on credit cards have been steadily increasing over the last two decades – even when Bank of England rates were falling. Cynically, several banks then pegged their credit card interest rates to base rate once it hit all-time lows – so many of the recent rises have been automatically triggered by the recent Bank of England rate rises.

“It underlines the fact that you should always avoid keeping any long-term debt on credit cards – as it’s one of the most expensive ways to borrow. Credit cards can offer great value if you pay them off in full every month. But the costs of tripping up are getting higher and higher. So if you’re not confident you can use them in the right way – then they are better avoided.”

A recap on the Santander 123 cashback credit card

The Santander 123 credit card was withdrawn from sale in October 2016. For existing customers with the plastic, it charges a £3 a month fee and in return, holders receive the following:

- 1% cashback at all major supermarkets (on spend of up to £300 per month)

- 2% cashback at all major department stores (on spend of up to £150 per month)

- 3% cashback at all major petrol stations and on National Rail and Transport for London (TfL) travel (on combined spend of up to £100 per month).

Across these categories, the cashback is capped at £9 a month (£3 per category), meaning credit card holders can earn a maximum £6 a month after fees – up to £72 a year.

The credit card was more generous previously, as it had no cashback limit on supermarket spends or in department stores, while there was a £9 a month curb on National Rail and TfL transactions. The monthly charge was also previously £2 a month, while the standard interest rate has climbed from the earlier 12.7%. The card also currently comes with 0% foreign transaction fees.