Today’s thirty-somethings have gained a thirteen-year head start with their pension saving and retirement planning compared to the previous generation who regret not starting sooner, research reveals.

Before the age of 36, just 23% of adults surveyed by Standard Life said they would pay more than the minimum auto-enrolment contributions into their pension. But that figure rose to 35% for 36-year-olds.

Standard Life said this is a positive sign, particularly as the majority of today’s retirees expressed regret about how they approached planning, with current retirees admitting they waited until the age of 49 before planning their pension.

It suggested that at the age of 36, workers have potentially ten years of continued employment under their belt and more cash in the bank. Plus, they also have more confidence to take on greater financial commitments.

A total of 63% of 36-year-olds felt confident in their abilities to make financial decisions, which dropped to just 54% for younger groups, according to the data.

However, while security is found in milestones like marriage and homeownership in your mid-30s, the prospect of working for another three decades remains a concerning thought for many.

When asked how they felt about the prospect of working for at least thirty more years, a fifth of those in their thirties felt ‘depressed’, while 14% felt ‘tired’ and 11% were stressed at the prospect.

As the younger generation expressed concern over the future, 55% of retirees wished they’d thought about retirement sooner.

Those in their thirties have ‘challenges like tuition fees to contend with’

Despite millennials making positive moves to secure their future, there are many hurdles facing this generation, says Sangita Chawla, managing director at Standard Life.

She said: “Our thirties is the decade that for many people things start to fall into place professionally and personally, and that you start to achieve those life milestones such as buying property, having a child or settling with a partner.

“Financially, it’s also the time many of us start to feel a bit better off and it’s this combination of a motivation to save and the ability to do so that start to come together.

“The next generation of retirees will be facing a very different situation to those currently retired, many of whom have benefitted from defined benefit (DB) pensions meaning they’ve not needed to take as much responsibility for their own retirement funds. With DB pensions fading out, future retirees must take matters into their own hands.

“For those doing so there are a number of headwinds in the form of high housing costs, a cost-of-living crisis with added challenges like student tuition fees to contend with and it’s likely many will face trade-offs when it comes to meeting today’s costs versus planning for retirement.”

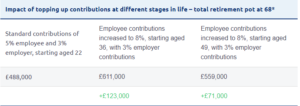

Impact of topping up contributions

For those who are able, topping up contributions by 3% at 36-years-old could mean an extra £120,000 in the pension pot to enjoy during retirement.

*if beginning working with a salary of £25,000 per year and paying 3% employer, 5% employee monthly contributions into a workplace pension and assuming 5.0% investment growth and 3.5% salary growth per year.