News

Treasury to probe ‘punitive’ pension freedom charges

The Treasury is to launch an investigation into excessive early exit charges imposed on people cashing in their pension pots.

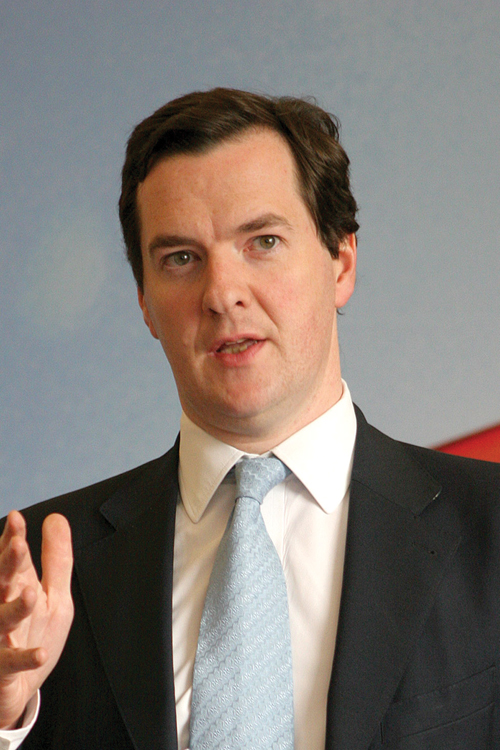

Speaking at Prime Minister’s Questions, Chancellor George Osborne said the Treasury’s consultation, due to launch next month, will look at ensuring people are not charged excessive early exit penalties. This could include imposing a cap on these charges for those aged 55 or over.

The consultation will also look at the process for transferring pensions from one scheme to another quicker and smoother.

The new pension freedoms, which came into effect on 6 April, allow people to access their savings how and when they want.

So far 60,000 savers have taken out a total of £1bn since the pensions freedom came into effect, according to government figures.

However, reports have emerged of investors experiencing problems accessing their retirement savings.

In a statement, the Treasury said: “The government has already strengthened the right to transfer to a new pension scheme but is clear that it wants all individuals to be able to transfer their pension easily, within a reasonable timeframe and at reasonable cost, so that they can take full advantage of the new flexibilities.”

Tom McPhail, head of pensions research at Hargreaves Lansdown, said: “The government appears to be losing patience with those elements of the pensions industry which are failing to measure up to the promises of freedom.

“Every pension investor over the age of 55 should be able to access their retirement savings with the minimum of cost and administrative inconvenience. It is not acceptable to charge punitive exit penalties or to insist that investors pay for a financial adviser. Any pension providers or schemes which can’t or won’t deliver should let their customers leave so that they can benefit from the freedoms elsewhere.”