Retirement

130,000 pensioners expected to access savings flexibly

The government expects 130,000 pensioners per year to access their retirement savings flexibly, according to a policy impact document.

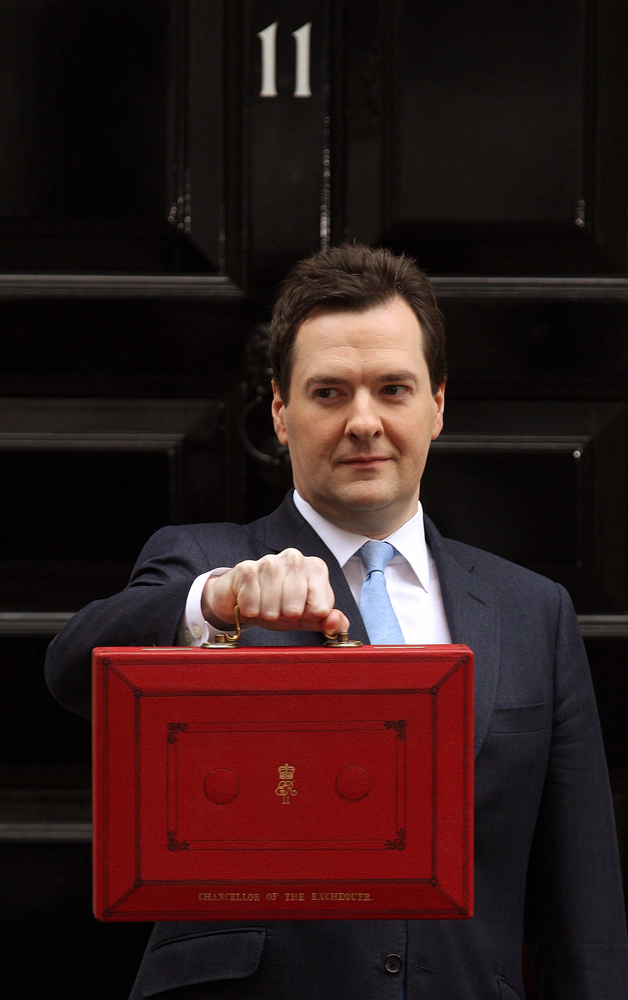

Around 5,000 people per year accessed their pension savings flexibly before George Osborne did away with rules dictating how retirees could use their savings.

Under current rules only pensioners with very large or very small pots can access their savings flexibly. As of 6 April 2015 all Brits over age 55 will be able to use their life’s savings as they see fit.

While the new rules allow pensioners to withdraw their entire pension pot in cash, just 25 per cent will be tax free. The remaining 75 per cent will be taxed as regular income. According to calculations by Hargreaves Lansdown this could result in a £3.8bn windfall for the government over five years.

Hargreaves found that a basic rate taxpayer with an income of £20,000 and a £100,000 pension pot could end up paying 26 per cent tax by withdrawing a cash lump sum, while a higher rate taxpayer with the same size pot and an income of £85,000 could lose 34.5 per cent of their pot’s value to tax. The savers would be left with £74,373 and £65,500 respectively.

Tom McPhail, head of pensions research at Hargreaves, said: “Tax could easily wipe out a sizeable chunk of people’s pension savings, potentially taking people into the higher rate tax band who have never paid tax at that rate before. Trusting people to act responsibly with their pension savings is a huge step forward but it is essential to back this with the right guidance and advice.”