As the new tax year begins, many investors will be looking to take advantage of the breaks available to them – particularly on ISAs.

ISAs were introduced by the UK Government in 1999 to encourage people to save or invest some of their disposable income.

There are two main types – cash ISAs and stocks and shares ISAs– with different risks and rewards.

You can’t carry over any unused allowance into the following tax year. So, here are stocks and shares provider Vanguard‘s eight most important things you need to know about investing in an ISA:

- There is an annual limit to the amount you can invest in ISA

The most you can currently invest in an ISA in a tax year is £20,000, which runs from 6 April to 5 April the following year. This overall allowance covers the different types of ISA, so if you invest £10,000 in a cash ISA in a single tax year, you can only invest a maximum of £10,000 in your stocks and shares account in the same year. You can’t carry over any unused allowance into the following tax year.

This year’s Spring Budget saw Chancellor Jeremy Hunt propose a new ‘UK ISA’ to give investors an extra £5,000 allowance on top of the current £20,000 ISA allowance to invest in UK investments. The Government is still due to consult on the details.

- There are tax advantages to the investments

Investments held outside of an ISA in a general account are subject to income tax if they generate dividends or interest, and you could also be liable for capital gains tax (CGT) if you make a profit when you sell any of these assets.

In the 2023-24 tax year, everyone had a tax-free CGT allowance of £6,000, but this fell to £3,000 on 6 April. Given that investments held in stocks and shares ISAs are exempt from CGT, it can be beneficial to invest some of your disposable income in an ISA. Just remember that investing carries some risk, so the value of your investments can fall as well as rise.

- The earlier you start investing, the better

Even if you are unable to take advantage of the full £20,000 annual allowance, it is worth investing as much as you can afford. Through the power of compounding, you will get returns on the money you invest as well as on any gains you make, so the sooner you set up your stocks and shares ISA, the greater the potential benefits.

- Costs matter

Investing through an ISA means saving on tax. However, there is still the not-so-small matter of your costs, which include the ongoing charges figure (OCF) of the funds you invest in as well as the account fee of your provider.

While a difference of one or one-and-a-half percentage points might not seem like much at first glance, over time, costs can reduce the amount of positive compounding you can enjoy by taking away from your investment return.

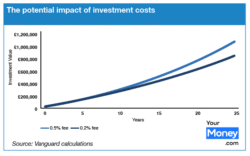

Take a look at the chart below, which assumes an annual £20,000 ISA investment with a 5.5% annual return for both scenarios. The blue line is a low-cost investment with fees of 0.5% per year, so a net return of 5%. The orange line is a higher-cost investment with fees of 2% per year, so a net return of 3.5%.

The potential impact of investment costs over time

(Click to enlarge)

The low-cost investment takes just under 25 years to reach £1m, while the high-cost one will be worth only £779,000 at that point. It would take nearly 30 years to reach £1m with the high-cost investment, while at that point the low-cost investment would be worth almost £1.5m.

With an annual account fee of just 0.15% and OCFs that average 0.2% across all our funds, you can cut your costs still further – whether you choose to build your own portfolio or pick one of our ready-made multi-asset portfolios.

Alternatively, if you are looking for expert guidance, there is also the option to take out an ISA with our managed service, where we do all the hard work for you for a total cost of 0.6% per year. This covers management fees as well as the account fee plus all your fund costs (including any variable transaction fees).

- ISAs can be transferred between providers

If you have an ISA with another provider, including a cash ISA, you can transfer its holdings to a Vanguard stocks and shares ISA. To do this, you will need to provide us with your personal information and details about the ISA you want to transfer, and then we can make the switch.

Just remember that transferring from a cash ISA to a stocks and shares ISA involves taking on more risk with your money. Also be aware that when transferring between stocks and shares ISAs, you may be out of the market during the time it takes for the transfer to complete.

New rules that came into effect on 6 April allow you to open and pay into multiple ISAs of the same type in the same tax year. You can, for example, open a stocks and shares ISA with one provider and then open another stocks and shares ISA with a different provider a few weeks later. Remember that you must remain within your £20,000 allowance across all of your ISAs.

- You can withdraw your money from a flexible ISA at any time

Vanguard’s options are flexible, so you can withdraw cash and then put it back in during the same tax year without reducing that year’s allowance. There is no minimum withdrawal amount or minimum account balance.

However, bear in mind that ISAs are designed for longer-term saving so, if you withdraw any money, you are reducing the amount you have invested in the market. This could limit the potential for that money to compound over time, so it may not generate the expected returns.

- Junior ISAs are available for anyone under the age of 18

Junior ISAs must be set up by an adult with parental responsibility for a child and have an annual allowance of £9,000. They are potentially an excellent way for your child to fund themselves through higher education, for example, or to start saving for a deposit on a house. When the child turns 18, the junior account automatically converts into adult cash or stocks and shares accounts in their name.

- ISAs can be inherited after you pass away

ISAs can be left to a surviving spouse or civil partner without forfeiting the tax benefits, and they can add the funds to their account without being subject to the annual £20,000 allowance. The surviving spouse or civil partner is entitled to an additional permitted subscription up to the value of the deceased person’s ISA.

If you pass on your ISA to someone who isn’t your spouse or civil partner, it may be subject to inheritance tax.

James Norton is head of financial planners at Vanguard