News

Chase increases savings rate today

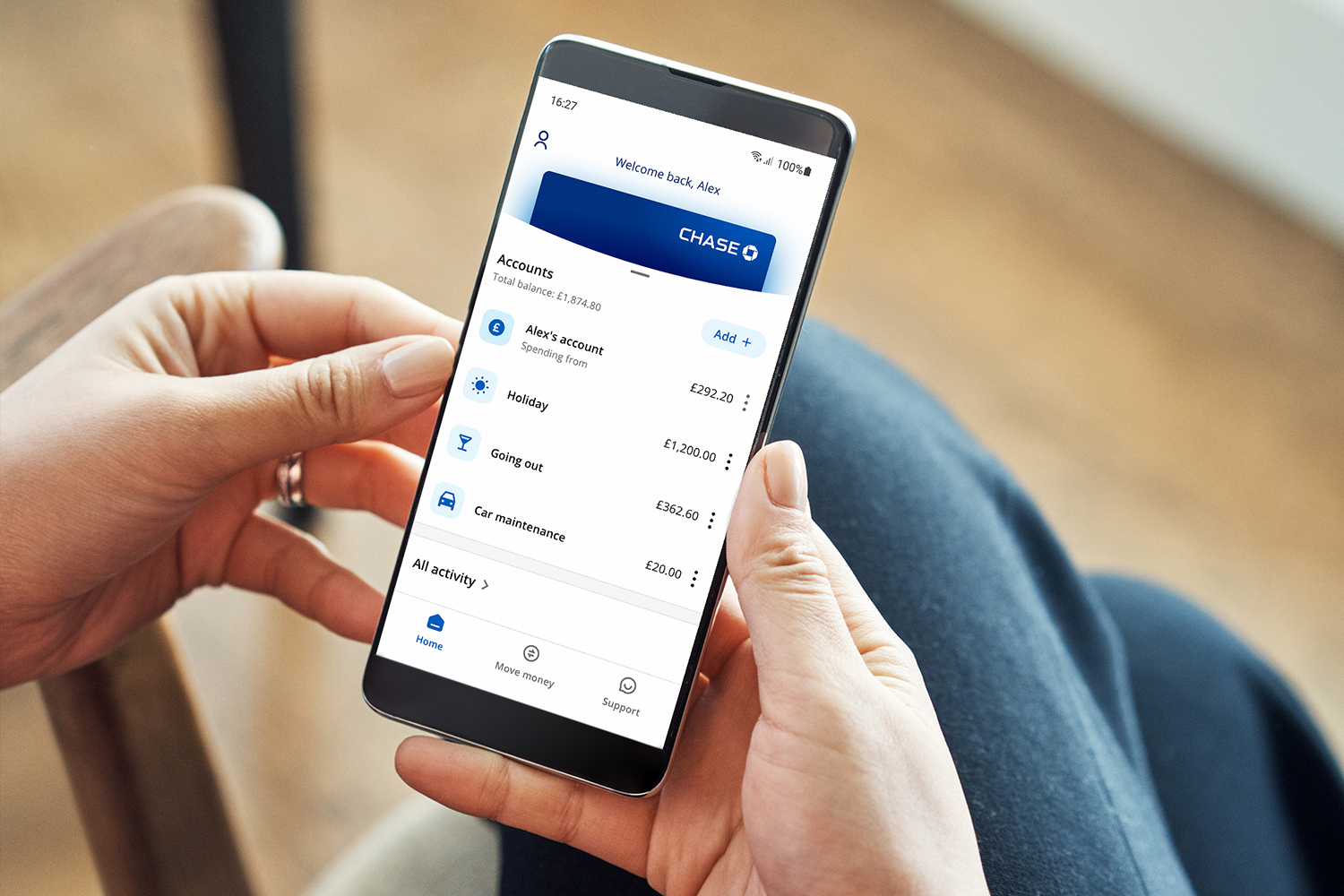

Digital challenger Chase has increased the rate on its popular saver account from 1.5% to 2.1% AER today.

US banking giant JPMorgan Chase has increased the rate on its easy access savings account from 1.5% to 2.1% AER (2.08% gross) variable from 24 October (today).

The higher rate will be applied automatically to both new and existing customer accounts.

Interest is paid monthly and a maximum of 10 saver accounts can be opened by customers, with a maximum deposit of up to £250,000 in total.

Shaun Port, managing director for everyday banking at Chase, said: “We’re increasing the rate on our saver account to help new and existing customers make their money work harder, in what we know is a challenging time for everyone.

“With costs increasing, having greater flexibility and access to savings, without being charged fees, is increasingly important for people when managing their money. The Chase saver is linked to Chase’s current account which offers 1% cashback on everyday debit card spending for a year, and 5% AER interest on small change round-ups.”

The easy access savings account was launched in March 2022 where it offered a market-leading rate of 1.5% AER.

However, the increase to 2.1% AER doesn’t make Chase market-leading. Currently savers can earn an expected profit rate of 2.81% AER from Sharia-compliant Al Rayan Bank (minimum £5,000) or an expected profit rate of 2.8% AER from Gatehouse Bank for a lower minimum £1 deposit, according to Savings Champion data.

But for existing customers who already bank with the digital challenger, it is a welcome boost.

Since the launch of its UK bank account in September 2021, one million customers have come on board.