Half a million UK residents could be without a local bank branch next year, particularly impacting the elderly and vulnerable population, analysis reveals.

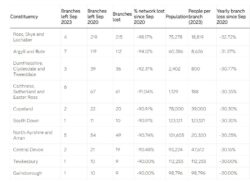

If the current bank branch closure trend continues, the area set to be hit hardest in the UK will be Ross, Skye and Lochaber. The Scottish constituency has already lost over 98% of its branches in three years – nosediving from 219 in September 2020 to just four open today. Based on its population of 75,278, this means the four branches may be required to serve 18,819 people each.

In fact, four areas of Scotland are most at risk of having zero branches by 2024, according to SAS UK data.

Argyll and Bute, Dumfriesshire, Clydesdale and Tweeddale, as well as Caithness, Sutherland and Easter Ross have been flagged as areas likely to have no branch network next year, based on forcasts of yearly bank loss data.

In England, Copeland is most likely to be ‘bankless’ next year, as just two branches are operating in the Cumbrian constituency for its 78,000 residents – compared to 22 that were open three years ago.

SAS UK said the majority of areas likely to have zero branches next year are rural, and not population dense. Some also have an older age profile, meaning that people are likely to require in-person services more, according to the analytics platform.

Based on branch data across seven major banks, SAS research discovered there are already 28 constituencies that have zero banks, with St Helens North, Bradford South and Don Valley losing their last physical branch in the last three years while Nottingham East residents lost all four remaining branches.

Only three constituencies in the UK saw a rise in the number of branches in the last three years – Burton, South East Cambridgeshire and Wolverhampton North East saw a rise by one branch – while 21 areas saw no change.

Meanwhile, Stoke-on-Trent North, Sheffield Hallam and Derby North are clinging on to just one bank in their area.

SAS said while online banking does provide access for banking services for individuals who may be geographically distant from physical branches, “in-person branches remain crucial for those with disabilities that mean there are technological barriers”.

In-person banking services still provide crucial help

Louise Potts, head of banking at SAS UK, said: “The way that we bank has significantly changed in recent years, as banks respond to the needs of many businesses and consumers who choose to do their banking online, rather than visit the local branch. Whether it’s transferring money between accounts, applying for credit cards or paying your bills, online banking enables millions to enjoy instant access to their finances.

“It is great for simple transactions and can enable staff in branches to focus on more complex issues. However, the general trend towards more online banking has led to numerous closures of banks and building societies across the UK’s high streets.”

It said that some may see banking hubs as the answer to bridge the gap between physical branches and online banking preferences.

There are currently seven hubs open in London, Devon, Lanarkshire, Angus, East Yorkshire, Essex and South Ayrshire, with 61 additional hubs planned for communities across the UK.

Owned by Cash Access UK and run by the Post Office, they provide access to services provided by a number of high street banks, giving people the option to deposit, transfer and withdraw cash from most major banks, just as they would do in a typical branch.

Potts added: “The financial ecosystem is undergoing radical changes, and a hybrid banking approach, whereby people and businesses have access to in-person and online banking capabilities, is important. Ultimately, the banks that succeed will be hyper-effective AI organisations that also use analytics to provide heightened responsiveness, tackle fraud, but also meet customer needs across all channels.

“In-person banking services provide crucial services if you’re struggling to access the internet or find a solution online. In particular, they’re important for the vulnerable and elderly within the population.”

The 10 areas set to be bankless in 2024

(Click to expand)

Source: SAS UK