News

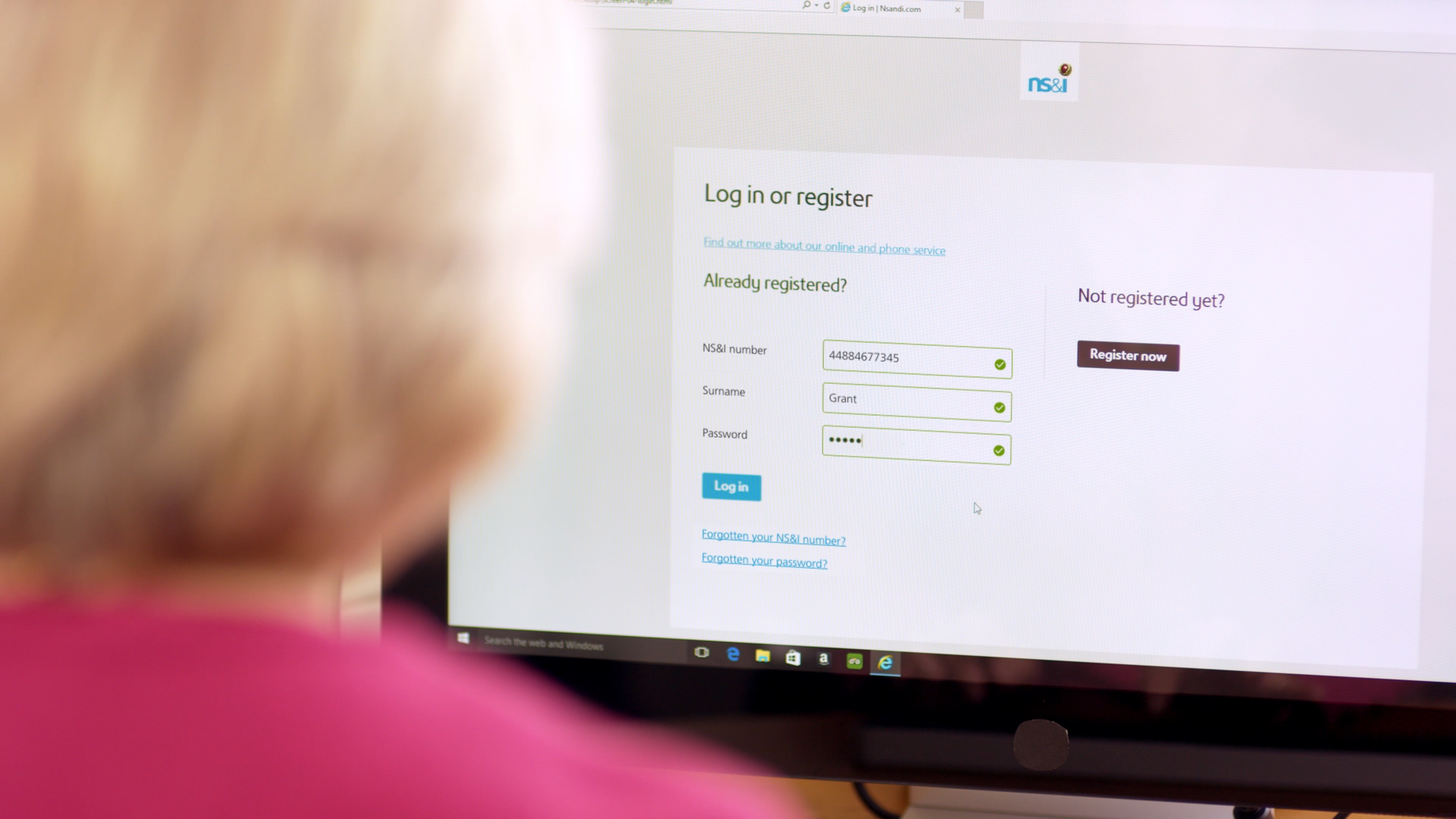

NS&I offering some of the best savings deals including top easy access rate

NS&I now offers some of the top-paying savings accounts on the market following its decision to cancel planned rate cuts due to come into force on 1 May.

The government’s savings arm announced a host of interest rate cuts in February but u-turned on its plans in a bid to help savers during the coronavirus crisis.

The decision means it currently tops two of the best-buy tables: 1.16% on its Income Bond puts it top of the easy access accounts and 3.25% is top for cash junior ISAs.

Sarah Coles, personal finance analyst, Hargreaves Lansdown, said: “NS&I is attracting some love in a time of coronavirus.

“It already has more than a third of people in the UK as customers, and its response to the crisis so far is winning over plenty more.

“While other competitive accounts have been battered by the interest rate environment, these accounts are standing strong.”

NS&I products have always been popular with savers because the money is 100% guaranteed by the government.

In fact, a survey by Hargreaves Lansdown found just 7% of the 25 million NS&I customers picked their accounts for the competitive rate.

Just under a third (30%) said it was because their money was safe, and 13% said it was because of their trust in the brand.

Over a third (36%) said they saved with the organisation because of the attraction of winning a big prize on Premium Bonds.

NS&I also offers an interest rate of 1% on its Direct Saver, and 0.9% on its easy access cash ISA.