News

One year left to spend paper £20 and £50 banknotes

The Bank of England is encouraging people to spend or deposit their old £20 and £50 banknotes before they are withdrawn from legal tender in a year’s time.

There are around £9bn worth of paper £20 and £15bn worth of paper £50 notes still in circulation, the Bank said.

These will lose their legal tender status from 30 September 2022.

They are being replaced with new polymer notes, which have additional security features and are resistant to dirt and moisture so last longer. They also have tactile features that allow the blind and partially sighted to use them.

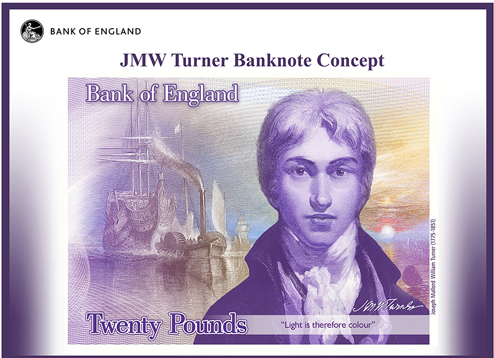

The polymer £20 features artist J.M.W. Turner and was first issued on 20 February 2020, while the £50 polymer note, featuring scientist Alan Turing, has been in circulation since June 2021.

Bank of England’s chief cashier, Sarah John, said: “In recent years we have been changing our banknotes from paper to polymer because this makes them more difficult to counterfeit, and means they are more durable.

“The polymer £20 featuring the artist J.M.W. Turner, and the polymer £50 featuring the scientist Alan Turing are now in wide circulation, and we are in the process of withdrawing their paper equivalents. So, we want to remind the public that they have one year from today to spend their paper banknotes.”

After 30 September 2022 people with a UK bank account will still be able to deposit withdrawn notes into their account. Some Post Offices may also accept withdrawn notes as payment for goods and services or as a deposit to an account accessed via them.

The Bank of England will continue to exchange all withdrawn notes.