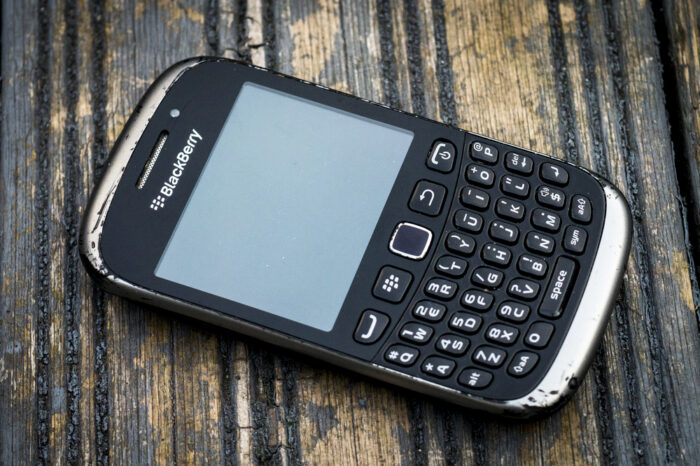

In a landscape dominated by the perennial iPhone versus Android debate, it's often overlooked that the true trailblazer in the smartphone industry was BlackBerry. But, the story of BlackBerry underscores a fundamental failure to adapt to the swiftly changing technological paradigms.

The BlackBerry device that preceded the iPhone wielded an addictive allure so potent it earned the moniker “CrackBerry,” captivating tech enthusiasts, who deftly manoeuvred its small keyboard with both thumbs, often – as I know from experience – with great difficulty.

However, the landscape shifted significantly when Steve Jobs introduced the iPhone in 2007. It became the ultimate disruptor in the industry, creating a shift that not only engulfed BlackBerry, but also Nokia and Motorola, as people expected far more from their handheld device almost overnight. The story of BlackBerry underscores a fundamental failure to adapt to the swiftly changing technological paradigms.

Artificial Intelligence (AI), robotics, nanomaterials, biotech, bioinformatics and quantum computing are just some of these technologies transforming the world. Digital technologies such as mobile, social media, smartphones, big data, predictive analytics and cloud are fundamentally different than the preceding IT-based technologies.

I’ll be honest in saying the whole idea of the Internet of Things (IOT) seems a complete impossibility to me a decade ago. For those like myself who are not necessarily in the know, the IOT is a rapidly growing technology which aims to connect all devices to existing infrastructure. That’s not just your phone – think about your alarm clock knowing your office location, path, traffic conditions and is clever enough to not only create an estimate of your arrival time (like City Mapper) but also wake you up accordingly. No traffic on the road means more sleep for me – which helps when you get older!

In today’s realm, UK investors are increasingly enthusiastic about tech. In fact, the Investment Association Technology and Technology Innovation sector enjoyed net retail sales of £46m during August, making it the fifth biggest seller*. The sector itself now has more than £7bn of assets under management**.

However, the query persists: where should investors direct their focus for forthcoming technological trends?

1) Artificial Intelligence

There’s always something new and exciting in the IT world and the current buzz centres around AI. One of the first investment houses to this area was Sanlam Investments UK, the boutique asset manager that operates a number of specialist portfolios.

The Sanlam Global Artificial Intelligence fund was created to take advantage of the longer-term opportunities presented by AI. Interestingly, the fund uses an AI system itself to find companies whose business models are most likely to benefit. The companies it favours are engaged in various activities to do with AI, including research and development, and the provision of services.

2) Digital infrastructure

Those looking for the newest trend in technology might look further afield to digital infrastructure. Data consumption by businesses and consumers is continuing to grow exponentially, driving demand for all types of digital infrastructure—notably fibre optic, data centres and mobile towers.

One portfolio I’d consider in this space is the Schroder Digital Infrastructure fund, which seeks to take advantage of the ever-increasing demand for digital infrastructure and the sustainable transition to a digital economy. It’s hard to argue against the logic of this fund. Our demand for data is insatiable and this will require ever more digital infrastructure in the future.

3) Health tech

Another area we believe is set to benefit from the innovation in technology is healthcare. Healthcare is an industry lagging behind in its adoption of technology, so opportunities abound to improve patient outcomes and accessibility to healthcare globally. The Baillie Gifford Global Discovery fund has 44% in healthcare and 26% in technology*** offering investors exposure to healthcare innovation, alongside other broader areas of technology innovation.

4) Global tech

Those looking for an “all-rounder” might consider the AXA Framlington Global Technology fund. It’s been run by the highly experienced Jeremy Gleeson since 2007. The fund takes an unconstrained approach to investing in global technology businesses. This means it’s free to invest in so-called ‘new tech’ businesses, as well as older commodity companies. This gives investors broad exposure to the sector.

5) Technological change

The final fund to consider is GAM Star Disruptive Growth, which searches for companies that are set to benefit from the disruption caused by upcoming waves of technological change. Manager Mark Hawtin targets businesses that have technology at the core of their operations. The cross-industry approach means this is not just a tech fund, but the manager currently has 45% invested in the sector****.

*Source: Investment Association, October 2023

**Source: Investment Association, September 2023

***Source: fund factsheet, 30 September 2023

****Source: fund factsheet, 31 August 2023

Darius McDermott is managing director of Chelsea Financial Services & FundCalibre

Past performance is not a reliable guide to future returns. You may not get back the amount originally invested, and tax rules can change over time. Darius’s views are his own and do not constitute financial advice.