Household Bills

Take These: Six tax schemes Take That should have used

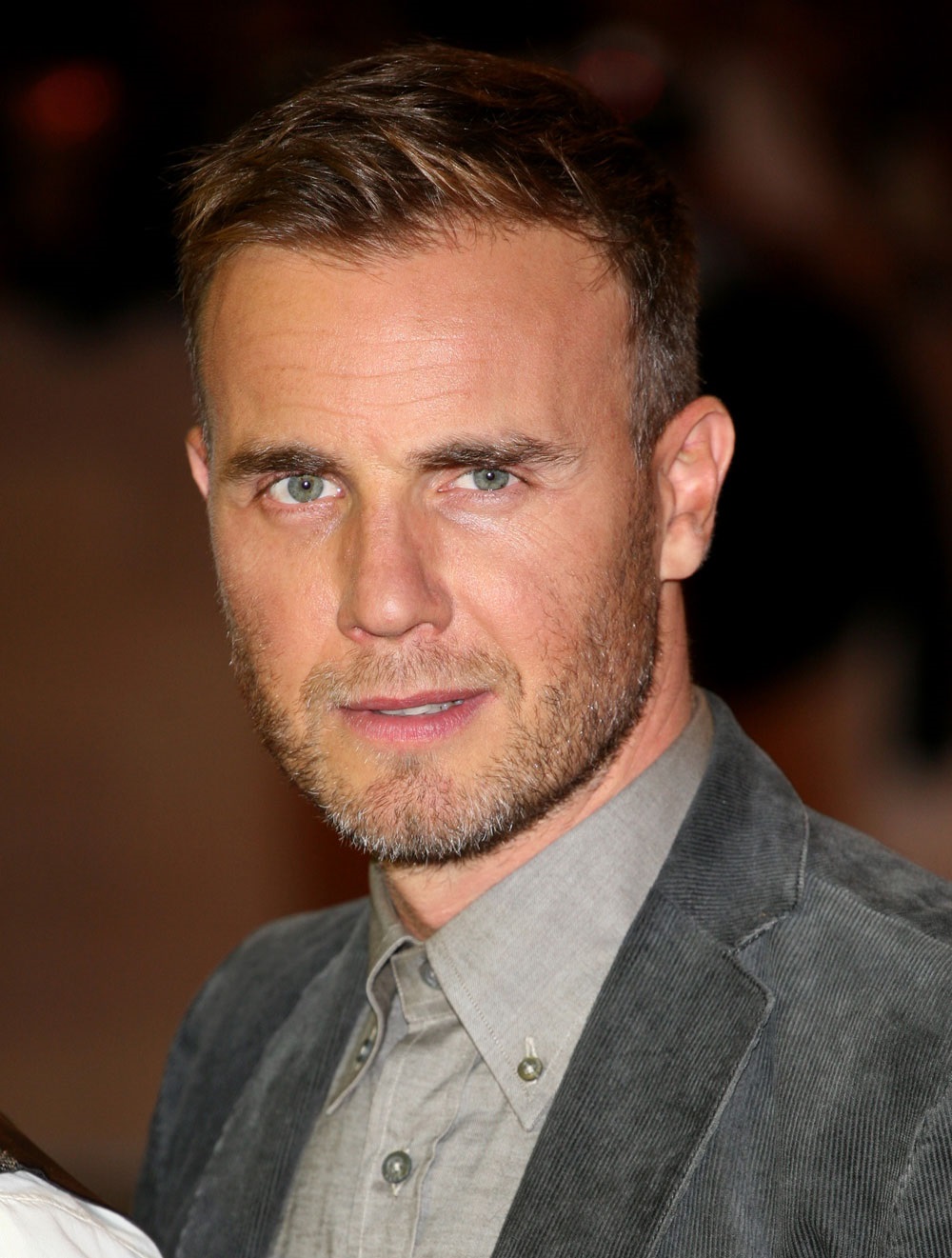

Much has been written in recent days on Take That’s Gary Barlow and band mates, after a court ruled that a scheme they were invested in was set up for tax avoidance purposes.

Tax avoidance schemes are a form of aggressive financial planning which will typically try to exploit legal loopholes and are never approved by Her Majesty’s Revenue and Customs (HMRC). Use of such schemes will mark you out as a high-risk taxpayer with the HMRC and expose you to considerable scrutiny. The Government and HMRC are strongly committed to cracking down on tax evasion and avoidance.

This type of questionable tax planning needs to be clearly distinguished from several perfectly legitimate, government-backed schemes, which allow people to invest in a tax efficient way.

Many of these schemes are extremely popular, including ISAs and pensions, while others are less well known.

Bestinvest’s managing director Jason Hollands takes a closer look at the options available, both for adults and for children.

• ISAs – One of the most popular tax allowances, ISA sales through funds alone reached £2.3bn for tax year 2013/14; over £1bn more than 2012/13 tax year according to figures from the Investment Management Association. With the allowance increasing to £15,000 on 1 July 2014 with New ISAs (NISAs), the popularity of the schemes looks set to continue.

While no tax relief is provided on the way in, returns on ISAs will accrue in a tax efficient environment and therefore they should be a cornerstone of a tax efficient savings strategy.

Up to 2 million more people are expected to have been drawn into the higher rate tax band by 2015/16 since the start of the Coalition, so it is vital to keep as much of your wealth as you legitimately can away from the hands of the taxman using these precious but flexible allowance.

• Pensions – Pensions have a very favourable tax treatment, offering up-front reliefs that ISAs don’t have (but you are tying your money up until you are at least 55). Currently, these reliefs are de facto at your marginal income tax rate, making them particularly attractive for higher (40%) and additional (45%) tax payers.

Pension contributions are “grossed up” by the government by 20%, so an £8,000 contribution turns into a £10,000 investment. However, those subject to the higher rates can effectively get a further rebate via their tax return as currently pension contributions reduce taxable earnings. In effect a 40% tax payer will get a further 20% benefit and a 45% taxpayer a further 25% benefit on top of the amount the government adds to their contribution. That means a higher rate taxpayer gets a £10k investment for a cost of £6k, and a 45% taxpayer a £10k investment for a cost of £5.5k – this is unrivalled for a main stream investment.

In the past, many people have been put off pensions as a result of poor fund choices, confusing charges and the lack of flexibility on retirement. Self-Invested Personal Pensions (SIPPs) have addressed this lack of choice as they enable savers to invest across a wide range of funds and have removed much of the complexity over charges, while the Chancellor heralded a pensions revolution in his recent Budget, which means no one will have to buy an annuity with their pension pot.

• VCTs – Venture Capital Trusts are specialist investments, targeted at more experienced investors. Investment in a VCT new share offer attracts a 30% income tax rebate, providing you have paid the level of tax being claimed and that you hold the VCT shares for at least five years. For someone in a position to invest the maximum annual allowance of £200k, that’s up to £60k tax credit available. Of course, anyone doing this is likely to have substantial assets already in more mainstream investments. All returns from VCTs are tax free and these can provide attractive dividend income streams for higher rate taxpayers.

• EIS – Companies eligible to receive Enterprise Investment Scheme (EIS) financing have the same characteristics of those which VCTs invest in; small, UK private companies but whereas VCTs are diversified funds, EIS investment is ploughed directly into these companies. Like a VCT, investment in an EIS carries a 30% income tax credit but you only need to hold the investment for three years, not five. So, the maximum potential relief is £300k on a £1m of investment each year.

While VCTs tend to generate attractive tax free dividends, EIS investments aim to generate a tax free capital gain. In the event the investment loses money, the investor can elect that the amount of the loss, minus the income tax relief received, is offset against their income tax liability.

EIS can be used as means to defer a capital gains tax liability for individuals who have made a gain on the sale of another asset. By reinvesting the amount of their gain into EIS companies, the tax liability is deferred and only recrystallizes once the EIS shares are sold.

If you have held EIS shares for at least two years and then die, they are eligible for 100% inheritance tax relief, so can be used in estate planning.

• Seed EIS – The Seed EIS scheme is relatively new and is aimed at incentivising investment into small start-ups by business angels. This is clearly aimed at sophisticated investors. Investors can receive 50% tax relief on their investment irrespective of their marginal rate. If they have made a capital gain, they can eliminate this by investing the gain into a Seed EIS and also get the 50% relief. With the top rate of CGT at 28%, for some investors this can add up to 78% tax relief. Of course, failure rates are high for start-ups, hence the huge reliefs on offer.

In addition, it is also worth flagging the tax allowances available for investors with children:

• Junior ISAs / CTFs – If you have children, you may be able to shelter a further amount for them in a Junior ISA (or child trust fund if they have one). As announced in the Budget, the Junior ISA allowance will increase to £4,000 from 1 July 2014. Junior ISAs provide a valuable means of building up a fund which can be used to support children through a future degree.