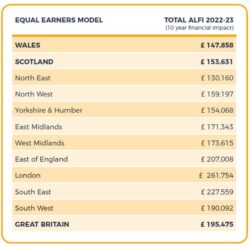

The basic financial cost of a parent dying is an average £195,000 over ten years, an insurer has revealed.

With only a third of UK adults having life insurance, this could lead to a heavy burden on relatives, especially when factoring in rising household bills, increasing mortgage payments and a cost-of-living crisis.

Life insurance company Beagle Street investigated how much a premature death would financially impact families in each part of the country, with Londoners seeing a staggering cost of £261,755.

The research analysed adverse life-event financial impact (ALFI) using a ‘defined family structure’, based on two partners as household parents with two children, where the partners earn equal salaries.

It also calculated that the average amount families would have to pay over ten years in Wales was £147,858 and Scotland totalled £153,631.

Meanwhile, in the North West of England, households would face an average monetary burden of £159,197 and in the North East, a £130,160 debt up until the children reached adulthood.

The study follows YourMoney.com’s guide to income protection, critical illness cover and life insurance, which highlighted the significance of finding a policy that matches your specific needs.

Cost of not having life insurance ‘may be much higher’

Beagle Street director, Beth Tait, said: “Our ALFI model is just a starting point for the most basic financial impact of a premature death, which in reality may be much higher, to cope with additional costs of running a family as a single, bereaved person.”

Tait added: “Although it’s not the easiest topic to discuss, it’s so important to understand what the impact of losing a contributing partner might be, given the responsibility of bringing up children while also potentially paying for a mortgage. It’s crucial to plan ahead to ensure families are protected financially should the worst happen.”

Cost of premature death on families

(Source: Beagle Street)