Experienced Investor

CEMENT – the growth prospect of the future?

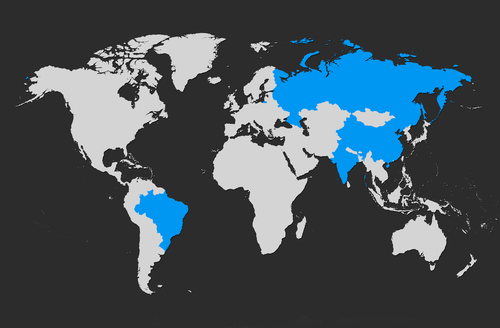

Fifteen years ago, the term BRIC entered the economic and political lexicon – BRIC being collective shorthand for Brazil, Russia, India and China, the quartet of major emerging markets believed to constitute the economic kingpins of tomorrow’s world. More recently, the contraction MINT (Mexico, Indonesia, Nigeria and Turkey) has entered popular usage.

However, what of other developing economies, neglected by such abbreviations? Well, they do in fact have their own acronym, reflecting their disregard in every sense – Countries in Emerging Markets Excluded by New Terminology, or ‘CEMENT’.

CEMENT was coined by Dr. Jerome Booth, a leading emerging markets economist. Booth argues that while growth in BRIC economies has been notable in the 21st century to date, it is part of a wider trend; that of more general economic strength in the emerging areas of the globe.

For Russ Koesterich, global chief investment strategist at BlackRock, the basic attraction of CEMENT is simple – why limit your emerging market investments to only a few countries when you can invest in up to sixty four?

“I don’t think there is any merit in a fund manager, or investor, artificially restricting themselves to an investment universe dictated by popular doctrine and vocabulary, rather than seeking out opportunities where they lie,” says Koesterich.

Rewards

“The obvious motivation for investing in CEMENT is to unlock growth at an early stage – and to do so comparatively cheaply,” says Tom Stevenson, investment director at Fidelity.

“The core rationale is to get involved before markets start rising, and be well-positioned to profit when they do.”

Nevertheless, investors on the hunt for an as-yet-overlooked future China may be disappointed. “There are few truly ‘undiscovered’ markets left, if any at all,” says Koesterich.

“The trick is finding the stones that the majority of investors have left largely unturned.”

Investors may also wish to consider the growing lack of correlation between CEMENT and developed markets. Overall, emerging markets now represent a bigger proportion of global economic activity than their developed counterparts – and can grow (or, indeed, shrink) without reference to established markets.

Just as the fortunes of BRIC nations surged during the economic downturn, so CEMENT can flourish despite still-stagnant growth rates in Europe and North America.

“We see investment in a broad array of emerging economies countries as not only useful diversification in a fund, but defensive action,” says Stevenson.

Risk

Inflation remains a major issue facing many of the world’s emerging markets. Currently, the 20 countries facing the highest rates of inflation are all drawn from the emerging world; among them are such hotly-tipped future prospects as Argentina, Brazil, Kenya, Nigeria, Russia, Uruguay and Turkey. The typical response of central banks to increased inflation is higher interest rates, which can hamper economic growth.

The concept of investing in as-yet unproven regions of the world, especially those for which not much tangible data exists, may also be a disincentive. For Adrian Lowcock of AXA Wealth, the answer is for investors to hedge by covering as diverse a range of emerging markets as possible.

“While that approach is speculative, you increase the chances of tapping in to a potential winner – if not several,” he says.

On top of casting a wide investment net, Stevenson recommends emerging market investors keep calm and carry on.

“Emerging markets are, almost by definition, not a short-term prospect. Their potential develops over time – so don’t succumb to jitters and withdraw yourself from the market at the first hint of volatility.”

Koesterich adds: “Emerging markets are very much the place to put money for the long-term. There are some issues, but opportunities are certainly there, if you search wide enough.”

Fund recommendations

Unfortunately, the majority of emerging market funds tend to focus on countries that comprise current popular acronyms and phraseology.

Lowcock believes the best way to get exposure to CEMENT nations is by holding at least one broad emerging market fund, such as M&G Global Emerging Markets. Investors can then complement this with funds that have a dedicated country or regional focus.

David Hambidge of Premier Asset Management offers a number of recommendations. The Schroder Small Cap Discovery fund focuses on emerging market investment opportunities too small for bigger funds. The JP Morgan Emerging Markets Income fund has a specific weighting towards frontier markets such as Saudi Arabia and Thailand, often overlooked by major emerging market funds. He also tips Charlemagne Magna Emerging Markets Dividend.

“This fund calls to mind Neil Woodford’s approach. It’s not for the impatient, but it does have a strong focus on income,” says Hambidge.

Andrew Summers of Investec Wealth & Investment likes the Templeton Emerging Markets trust, due to its “unique approach to valuation, which has led it to areas of the market neglected by others.”