Experienced Investor

Cheap China: Is Hong Kong the best way in?

Sharp falls in Hong Kong-listed shares mean investors are now increasing their exposure to China via this route, even as the onshore market opens up further to foreign investment.

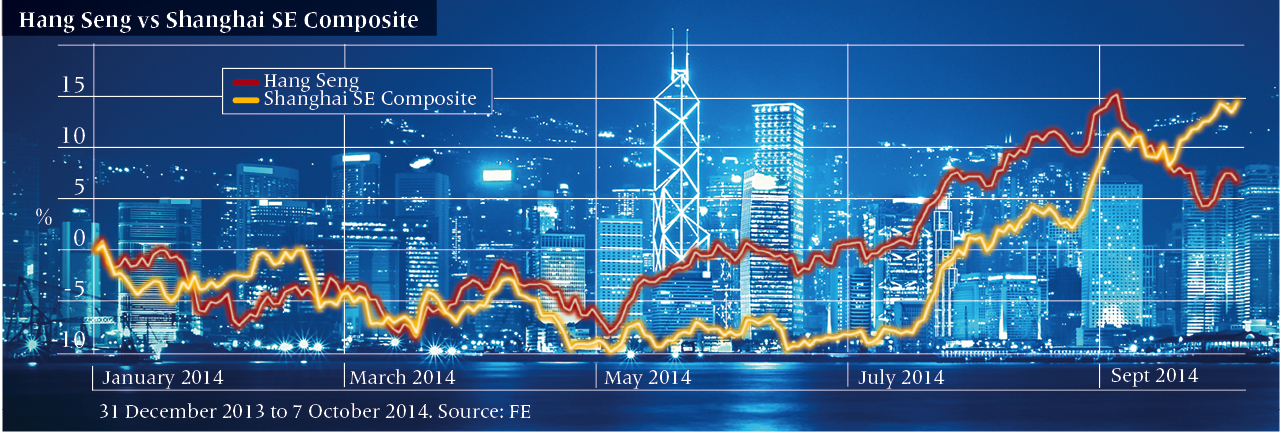

Over the past month, pro-Democracy protests have spooked investors holding Hong Kong-listed companies, with the Hang Seng index down 7.6%. The index is almost entirely populated by companies which derive their profits from China, but a sizeable gap has opened up between Hong Kong and mainland China indices.

The Shanghai composite index is up 2.4% over the month, and 12.5% year to date compared to a 1.2% gain year to date for the Hang Seng. P/E ratios also look more attractive for Hong Kong shares, with the Shanghai Composite currently on a trailing P/E ratio of 10.7x earning, compared to 9.6x for the Hang Seng.

This recent drop is a major reversal of previous trends. Despite mainland stocks’ impressive rally year to date, over three years they are significantly underperforming the Hang Seng, with a gain of just 0.2% versus 48%.

So are they an obvious buy over mainland stocks? Some investors argue so, claiming the short-term sell-off has opened up opportunities to access Hong Kong – and China – for much less.

Valuation opportunities

Karine Hirn, founding partner of emerging market specialist East Capital, said: “The recent underperformance of Hong Kong listed Chinese shares presents some interesting investment opportunities in specific subsectors, such as IT and autos.”

Hirn usually prefers to get exposure to China via the onshore market, where it is possible to gain wider access to domestic growth names, but she said the recent fall was too great to overlook.

“The [mainland] A-share market exhibits low correlation to other markets, so it is also ideal for diversification, but we still think Hong Kong shares look attractive at the moment.”

Mark Mobius (pictured) manager of the $13bn (£8bn) Templeton Asian Growth fund, told Bloomberg earlier this month he is gearing up to buy Hong Kong shares that have been punished in the sell-off.

“I am moving in,” he said. “The protest is important, and it should not be ignored, but it will not have an impact on Chinese companies.”

Some investors, including Nicholas Yeo, head of Chinese equities at Aberdeen Asset Management, have always favoured the offshore route because of higher governance standards.

“We advocate accessing these markets via shares of companies listed offshore. These could be non-Chinese companies that derive significant revenue from China,”

Yeo said. “Companies listed in Hong Kong, for example, are subject to higher standards of governance, and disputes are settled in a fair and transparent legal system.”

Dalton Capital’s Henrietta Luk, who manages the $146m (£90m) Melchior Asian Opportunities fund, agreed there are “plenty of good China related shares listed in Hong Kong”, adding she is more comfortable choosing offshore names.

Advantage of A Shares

While there are many supporters of H shares and other non-direct routes, more fund groups are attempting to launch funds investing in mainland A-shares.

Piquing their interest is the impact of the Shanghai Hong Kong Connect programme, which is set to kick off in mid-October.

The rule change will allow foreign investors to buy some 568 stocks listed on the Shanghai Stock Exchange through Hong Kong brokerage accounts, subject to an increased annual total quota of $48bn. Some managers expect this development to help close the valuation gap between H and A Shares.

Jonathan Pines, manager of the Hermes Asia ex-Japan fund, has some 8% in A Shares in anticipation of a move up. He said Hong Kong shares were still trading at a 7% premium to A Shares as of September.

“We believe that A/H dual-listed stocks’ valuation convergence should continue as the Hong Kong-Shanghai Stock Connect drives a potential arbitrage opportunity.”