Investing

How to succeed at succession if you run a family business

In the final instalment of a three part special on family-run firms, we look at succession planning.

If you run a family firm, it’s likely you’ve already thought ahead to who will lead when you’re ready to retire.

What can you do to improve your chances of achieving a smooth transition process?

Transition from one generation to the next is probably the most difficult challenge for any family business. It touches on the need to consider a time when the older generation is no longer around and forces consideration as to who is best placed to be the next leader of the family firm.

Alongside Family Business United we’re currently visiting 39 family businesses across the UK and one of the issues that has been raised time and again is that of ensuring a smooth transition from one generation to the next. Our response?

Succession planning requires time and commitment – not shying away from some difficult conversations – in order to be effective.

Why Life Insurance Still Matters – Even During a Cost-of-Living Crisis

Sponsored by Post Office

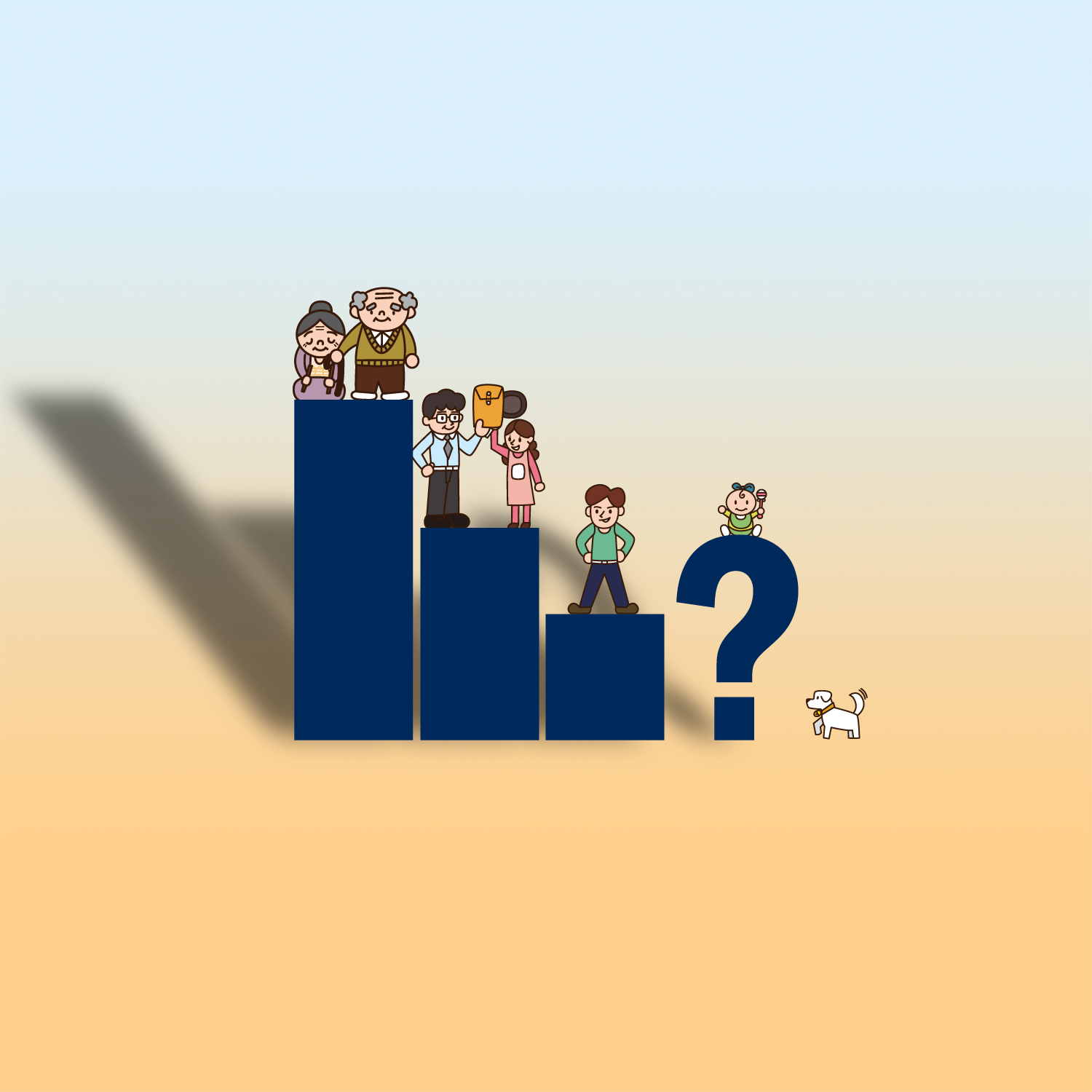

First and foremost succession planning is not easy. All too often, there is confusion between the need for management succession (selection of the next family business leader), and ownership succession (developing the next generation of responsible owners). The statistics speak volumes with only 70% of family firms making it to the second generation and less than 10% to the third.

For the existing generation, there is a need to extricate yourself from the family business financially and emotionally, which can be a difficult process.

In many cases you as the business owner are the largest asset to your business and you must consider how you can achieve a fair value for the business. This can be a difficult conversation as the next generation may need to source the necessary funds to purchase the shares in the business, or the ownership succession process may be deferred until a later date.

The transition process also calls into question the need to consider the longer term for the retiring generation – if you have more than one child how are you going to divide the estate down the line? The transition provides a timely opportunity to review and update wills and consider other aspects such as inheritance tax planning too. Seeking the advice of a qualified financial planner could potentially save much time, money and hassle here.

Key areas for you to address to give you a greater chance of succeeding at succession include:

– Having early discussions to determine if any of the next generation are interested in taking on the family firm, or external management may be needed

– Accepting that, as the older generation, the time is right for you to step back and being prepared to let go

– Creating a framework for employing next generation members in the family firm, the skills required and the rules for entry and exit

– Educating, training and integrating the next generation

– Creating a clearly defined and communicated process to be followed for selecting a successor

– Ensuring that you, the older generation, develop a life outside of the family firm

– Communication with the family and management team to provide security and support over the process

– Developing a shareholders agreement that determines who can own shares in the family firm and the roles of in-laws, together with an approach to the issue of divorce and share ownership

– Ensuring there is clear understanding within the family for the role and what it means to be a shareholder compared to involvement in the day-to-day running of the business.

Succession is a difficult process but one that can be dealt with professionally and in a manner that provides the greatest chance of success. To start with, all parties need to be in agreement that the succession process should commence and a clear and well articulated process should be drawn up.

Honesty is essential and must be supported by clear communication if succession planning to be a true success for you and your business.

Penny Lovell is head of private client services at Close Brothers Asset Management

Part 1: The backbone of Britain: Why family firms are so important

Part 2: How to prevent and resolve conflicts in your family firm