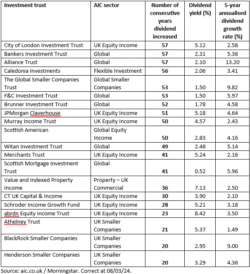

There are 10 investment trusts that have consistently increased their annual dividends for 50 years or more, showing “remarkable resilience”.

A total of 20 investment trusts have raised dividends each year for at least the last two decades, while half of these have increased payouts for 50 or more consecutive years.

Five dividend heroes have increased their dividends each year for 30-49 years, and a further five have raised their dividends for 20-29 years in a row.

According to the Association of Investment Companies (AIC), the City of London Investment Trust, Bankers Investment Trust and Alliance Trust have been paying dividend rises for the past 57 years.

The table below shows the full list of ‘dividend heroes’ with consecutive increased payouts (click to expand):

‘Dividend track records demonstrate their durability’

Annabel Brodie-Smith, communications director of the AIC, said: “Despite a tricky few years for the dividend heroes, 10 investment trusts now have at least half a century of consecutive annual dividend increases. They have continued to raise their payouts through the high inflation of the 1970s, recession of the 1990s, the global financial crisis in 2008 and the pandemic – showing their remarkable resilience.

“There are an impressive 20 dividend hero investment trusts in total that have increased their dividends every year for more than 20 years. Investment trusts have strong track records of dividend growth because they can hold back up to 15% of the income they receive each year. This allows them to hold more income in reserve when times are good to pay out in leaner years, providing a smoother flow of dividends to investors. Whilst dividends are never guaranteed, investment trusts’ dividend track records demonstrate their durability.”

A yield of 8% in 10 years’ time?

According to AJ Bell, income investors can generate a dividend yield of over 5% from five UK Equity Income investment trusts that have increased their dividend for 40 years on average.

The average yield is 5.8%, which beats cash savings accounts offering up to 5.25% on ISAs.

Laith Khalaf, head of investment analysis at AJ Bell, said that, unlike cash, capital and income is not guaranteed when holding shares.

“However, these trusts have increased their dividend each year for at least 23 years, through the dotcom crash, the global financial crisis, and the Covid pandemic. City of London Investment Trust has an unbroken dividend record stretching back to 1966, the year in which England won the football World Cup and number one records in the UK included songs from the Beatles, the Kinks and Elvis Presley,” he said.

Khalaf added: “There’s no guarantee of a rising income going forward, but the resilience shown by these dividend heroes over such a long time should provide investors with some comfort. Investment trusts can hold back income in the bad years to pay out dividends in the good years, a mechanism that has allowed some to continually raise their dividends for decades. This doesn’t increase the overall dividend yield produced by the underlying portfolio of shares, but it does offer investors a smoother ride, something that is especially prized by those relying on their investment portfolio to deliver a retirement income.”

He added that, based on the historical dividend growth achieved by these trusts, after 10 years they could be yielding 8% on an investment made today (based on a 5.8% current yield rising by 3.2% per annum).

As such, it also makes them “an attractive segue” for investors approaching retirement, particularly as dividends can be reinvested, “further bolstering their eventual income” when they come to draw on it, he said.

Cash rates are also expected to fall, but with the dividend allowance being halved to £500 in the new tax year, together with the fiscal drag of frozen thresholds, more taxpayers will be tipped into paying higher rate tax.

As such, investors should consider an ISA to protect their income.

Khalaf said: “A higher-rate taxpayer investing £20,000 in a portfolio paying 5.8% with dividend growth of 3.2% per annum would save £2,842 over 10 years by using an ISA. A higher-rate taxpaying couple using their ISA allowance at the end of this tax year and the beginning of next, so £80,000 in total, would save £14,744.”