First-time Buyer

‘Human-free’ mortgage advice service launches

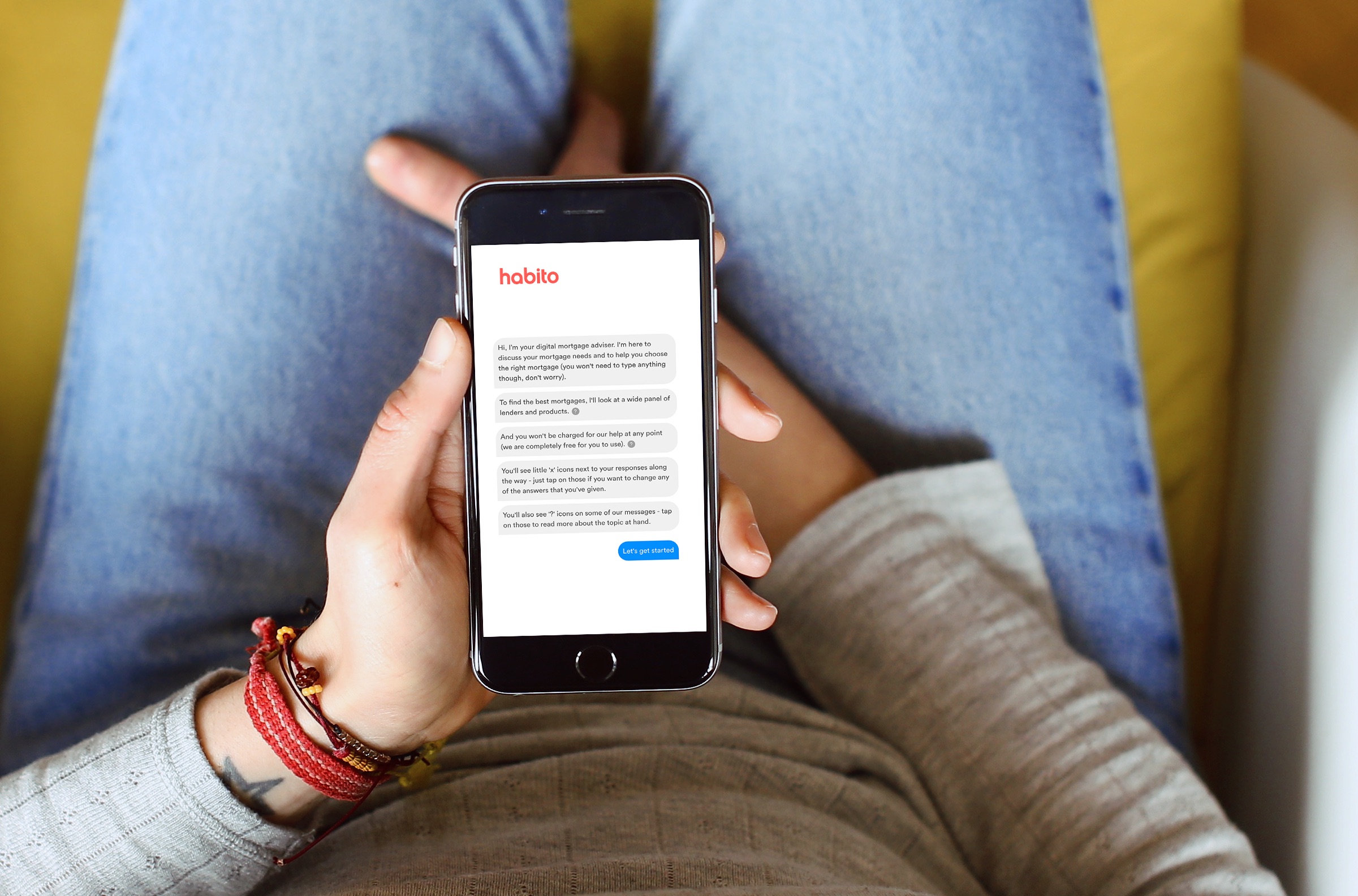

UK tech start-up Habito has created an artificially intelligent mortgage advice service, which claims to remove the need for a human intermediary in the home buying process.

Habito’s free service through its Digital Mortgage Adviser promises to deliver an average mortgage offer time of 10 minutes, using a sourcing system with access to hundreds of products.

Customers will be able to discuss their mortgage needs from any device, using artificial intelligence technology and an algorithm which combines the key elements of a borrower’s financial lifestyle with real-time mortgage rates to produce an indicative monthly payment.

Daniel Hegarty, CEO and founder of Habito, said: “Britons are crying out for some innovation and clarity in an outdated and overwhelming mortgage market.

“Our digital mortgage adviser is a huge step forward in making mortgage advice accessible for consumers in the way they need it most: unbiased, always available and most importantly free.”

Habito launched into the market in April this year, following a seed funding round and backing from fintech entrepreneurs. It followed shortly in the footsteps of Trussle, a mortgage advice firm with a similar proposition but with a focus on using a combination of human interaction and robo-advice.

Habito also took part in the Financial Conduct Authority’s Project Innovate, which offers a space for firms to test innovative products in a safe ‘regulatory sandbox’.

Leaders in the fintech sector are not the only commentators to denounce the state of innovation in the mortgage market. Last month, CEO of London-based mortgage broker Enness Private Clients, Islay Robinson, warned that intermediaries who failed to adapt in the changing market were exposing themselves to the threat of robo-advice.

Trussle.com’s CEO and founder Ishaan Malhi welcomed the launch of Habito’s service, but pointed out that a degree of human interaction was important in ensuring customers received the best outcome.

“Whether machine learning, AI or even digitising manual processes, it’s good to see more innovation in the market as it’s the consumer who will ultimately benefit,” he said.

“We know that our customers love the ability to complete a mortgage application from the convenience of their phone. At the same time, feedback shows just how much they value the personal touch. It’s important to optimise that balance of technology and experienced human advisers to make sure they get the right mortgage, in the shortest timeframe and with the least amount of hassle. Technology will of course play a vital part in achieving this, at scale and without the need to charge a fee.”