News

NatWest to close digital bank Bó

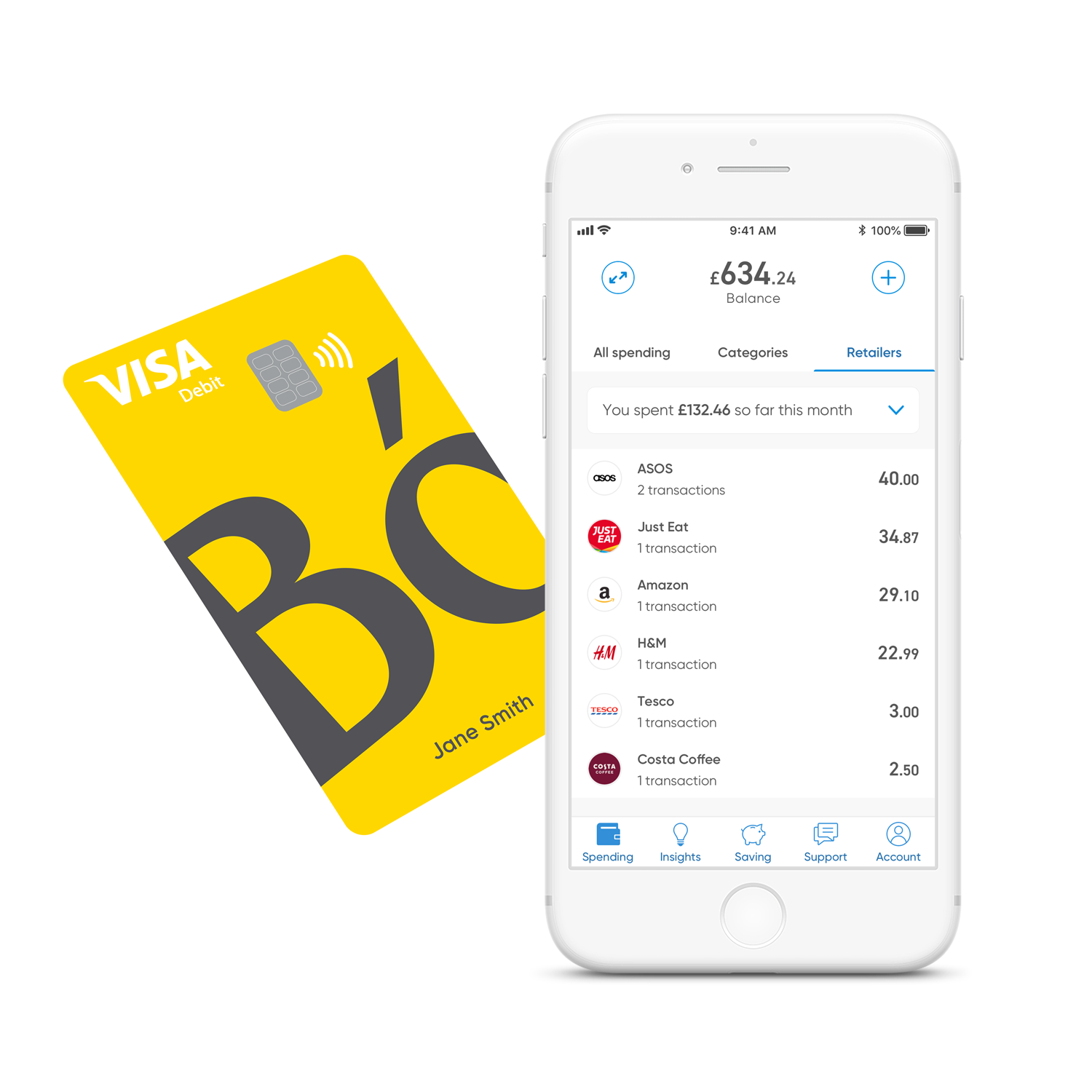

NatWest is set to close its app-only bank Bó, less than six months after it launched to rival the likes of Monzo and Starling.

The digital bank which launched in December and which offered fee-free overseas spending and cash withdrawals worldwide, is set to close.

Customers will receive at least 60 days’ notice and their money will remain safe. In the meantime, the 11,000 customers, including 3,000 NatWest staff, are urged to keep using their cards until the balance is down to zero, or transfer all their money out of the account.

To transfer money out of your Bó account, tap the ‘spending’ screen > tap on the two-way arrow icon in the top left-hand corner > tap on the payment details of the account you want to transfer money to and follow the prompts.

A statement on its website said it will be keeping customers up to date with more information soon.

A NatWest spokesperson said: “We are prioritising our investment spend across the bank on products and services that allow us to provide the best possible support for customers and colleagues. This is more critical than ever given the challenges we are all facing at this time.

“After careful consideration, we have made the decision to wind down Bó, and focus on our digital bank for SMEs, Mettle. The technology that underpins Bó will be integrated as we develop Mettle to better support our SME customers, who play such a crucial role in our economy.”

“As a bank, we will continue to test and learn, investing in innovative banking services that will provide a better experience for our new and existing customers, helping them to thrive.”