Average first-time buyer house prices range from £112,112 in Inverclyde in Scotland to £682,981 in Westminster.

As house prices can vary so much, 40% of young people are looking at more “affordable and up-and-coming areas to move to”.

While first-time buyers may need to make compromises, when it comes to priorities for property, 52% pointed to the price of the house, 38% cited being close to family and friends, while 37% were focussed on the crime rate in the area.

Community feel, transport connections, nearby supermarkets, good schools, better job prospects, green spaces and proximity to a major city made up the remaining top 10 priorities for first-timers.

Halifax revealed that the house price for those buying for the first time has nearly doubled in the past decade, while the average age has gone up by around two years to 32 over the same period.

Why Life Insurance Still Matters – Even During a Cost-of-Living Crisis

Sponsored by Post Office

However, the desire to own a property has stayed high at 87%, with a third saying they want to get on the housing ladder as soon as possible.

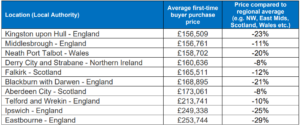

Top 10 up-and-coming locations for first-time buyers

As affordability tops the priorities list, Halifax has identified up-and-coming areas with lower average purchase prices compared to the surrounding region. It has also factored in crime rates, transport links to major cities, access to good schools, proximity to green spaces, ultrafast broadband availability as well as investment in local regeneration.

Here are the areas that make the grade:

‘Desire for a first home isn’t going away’

Kim Kinnaird, mortgages director at Halifax, said, “Despite fluctuating house prices, the desire to buy a first home isn’t going away, with almost nine in ten young people keen to get on the property ladder.

“There’s an appetite from under-35s to consider more affordable areas further afield, so we’ve identified up-and-coming locations that prospective first-time buyers might do well to look into. These are based on relatively low average house prices, alongside other positives such as access to green spaces, easy commutes and safe neighbourhoods.”