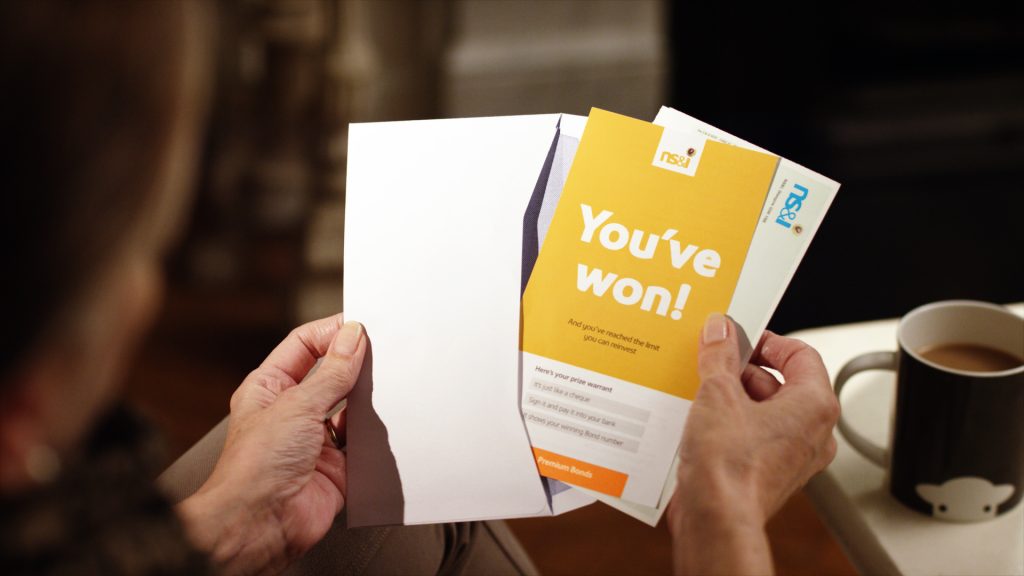

NS&I has confirmed that the Premium Bonds prize fund rate will be cut from the March 2024 draw, but the odds of winning will remain the same. Should savers still consider them?

The current 4.65% Premium Bonds prize fund rate will be reduced to 4.40% from the March 2024, bringing an abrupt end to 18 months of increases as NS&I looks to “strike a balance” between savers and taxpayers.

It comes after industry experts suggested back in November that savers should brace for NS&I rate cuts after it attracted nearly £10bn from savers in just six month – overshooting its net financing target for the whole year. The huge success of the 6.2% AER one-year Guaranteed Growth and Income Bonds boosted its coffers.

However, NS&I confirmed the odds of winning will remain the same from March, so each £1 bond has a 21,000-to-one chance of being drawn by ERNIE – the Electronic Random Number Indicator Equipment.

Compared to March 2023, the prize fund rate was 3.30%, with the odds of winning at 24,000-to-one.

Following the changes, the March draw is estimated to pay out over 5.7 million tax-free prizes worth £444m, compared to 5.8 million prizes worth £475m in January’s draw.

Andrew Westhead, NS&I retail director, said: “These changes reflect our requirement to strike a balance between the interests of our savers, taxpayers and the stability of the broader financial services sector. In a dynamic savings market, it’s important that our rates are set at an appropriate position against those of our competitors as we work towards meeting our annual Net Financing target.”

Are Premium Bonds still worth holding?

With the prize fund rate to stand at 4.40% tax-free in March, it is easily beaten by competitors who pay up to 5.22% AER on easy access savings (Metro Bank).

However, Premium Bonds aren’t like normal savings accounts as they don’t pay interest. Instead, the interest that should be paid is used to fund the monthly prize draw. The prize fund rate is intended to give savers a measure to see how it compares to normal savings accounts, but it shouldn’t be seen as an average return.

All-in-all, it means that for every £100 held in Premium Bonds, £4.40 will be paid out of the prize fund but this is based on a saver with average luck.

In reality, each month, there are two £1m winners, thousands who win between £500 and £100,000 and millions who win £100, £50 and £25. It also means each month many holders win nothing at all as in January’s draw, there were 122 billion eligible numbers.

However, part of the charm of Premium Bonds is the chance of winning the life-changing £1m jackpot. But for the majority of savers, having cash in an easy access account nets you guaranteed interest.

But, according to Anna Bowes, co-founder of Savings Champion, savers shouldn’t forgot that all prizes are tax-free.

Bowes said: “For those who pay tax on their savings, remember that all prizes are tax-free which may benefit higher and additional rate taxpayers, and those who have used their Personal Savings Allowance.

“If you were to win the equivalent of the new prize fund interest rate of 4.40%, as a basic rate taxpayer this rate is the equivalent of earning 5.50% on a taxable easy access account, 7.33% if you are a higher rate taxpayer and 8% for additional rate taxpayers.”

Meanwhile, Sarah Coles, head of personal finance at Hargreaves Lansdown, said: “If you are considering putting money into Premium Bonds, it’s not just the cut in the interest rate that needs to be part of the decision. You also need to consider the fact that in the average month, the average bond will win nothing, so Premium Bonds will be losing money after inflation.

“Now that so many easy access accounts are keeping pace with inflation, it’s important to be aware you’re paying the price for an outside chance of winning a life-changing sum of money. For many people, the certainty of a savings rate will still hold appeal, in which case it’s worth shopping around among the smaller banks, building societies and savings platforms for the best possible rate.”

More rate cuts on the cards?

Laura Suter, director of personal finance at AJ Bell, said NS&I will likely continue to bring rates down in small increments.

Suter said: “But the only direction from here is down for rates from the Government-backed provider. NS&I has already exceeded its fundraising target for the tax year. We’ve already seen NS&I pull its guaranteed bonds and cut the rate on its Green Savings Bond – further cuts to Premium Bonds are certainly around the corner.”

She added that “this is the biggest sign yet that the rates bonanza enjoyed by savers is coming to an end”.

“This is another signal for savers to shop around and nab the best rates before they fall further,” she warned.